The cost of college tuition has risen astronomically in the past decade.

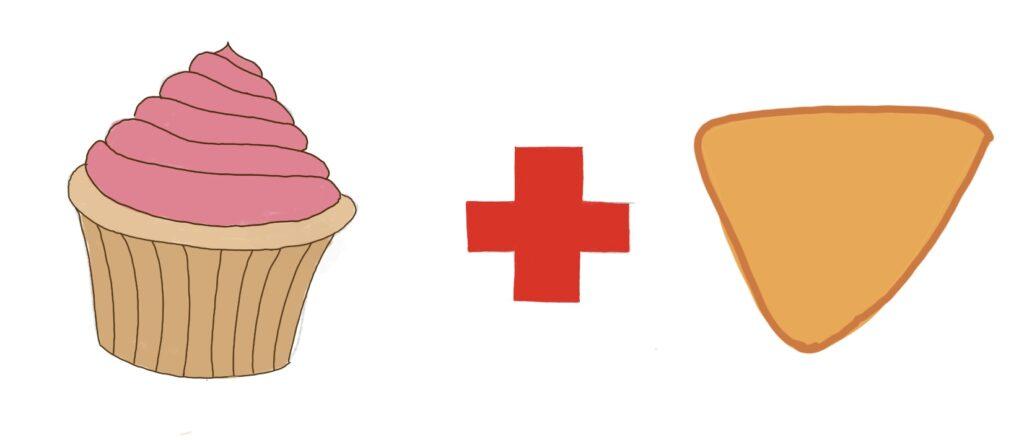

Last year, tuition alone for Ivy League schools increased by an average of 3.76 percent, raising costs to as high as $63,000 a year, according to Bloomberg. To put it into perspective, paying the four-year tuition of a prestigious Ivy like Columbia University can be likened to buying a 2016 Lexus GS 450h priced at $63, 080 a year for the next four years, or if a student doesn’t quite reach a degree, driving the equivalent of four Lexus cars off a cliff.

Though the cost for some colleges can be considered absurd, others have been deemed a worthwhile investment.

According to PayScale, an online salary information company, Harvey Mudd College ranks first in the “Best Value Colleges of 2015” list, with an average loan amount of $21,000 and the highest 20-year net Return of Investment (ROI) of $985,300.

The ROI is the difference between 20-Year median pay for a bachelor’s graduate and the 24-Year median pay for a high school graduate minus the total four-year cost of the school. In other words, a Harvey Mudd graduate would have $985,300 more in 20 years than a high school graduate, who decided not to attend college and worked at a low-education, low-wage job.

Senior Jacky Lee, who was admitted early decision to Harvey Mudd for computer science and mathematics, thinks the college received the highest ranking because of its supportive faculty. Lee attributed the cost benefits of attending a prestigious liberal arts school like Harvey Mudd to its student-oriented learning environment.

“I thought that Harvey Mudd was the best in terms of preparing undergraduates for the future,” Lee said. “The clinic program is excellent because it allows students to tackle real-world problems unlike some of the other schools where students do worthless busy work.”

Following Harvey Mudd on the list are less prominent colleges such as Stevens Institute of Technology, the Colorado School of Mines and Babson College in Massachusetts. Though not brand-name schools, these universities were reported to have a greater return investment than any of the Ivy Leagues. Princeton University is the first Ivy League university to appear at No. 9 on the list, Brown University is next at No. 15, and University of Pennsylvania (Penn) follows at No. 31.

Senior Jennifer Chen was accepted early decision to Penn as an undeclared major in the Colleges of Arts and Sciences. Though she said tuition was not a consideration in her decision to apply, she will be taking steps to cover the high tuition.

“I've been coaching volleyball for the last three years on weekends and have been saving money for college, and I'll be taking out college loans to fund my tuition,” Chen said.

Though the hefty yearly sticker price of $43,838 without room and board is not ideal, Chen hopes that the educational opportunities at Penn will be worth the cost.

Even so, prestige does not always mean prices that are out of reach.

Many top colleges have introduced policies to help alleviate student debts for low-income families, despite tuition hikes. Harvard University is known for helping pay any tuition a student is unable to afford, and according to Harvard’s financial aid website, 70 percent of

Harvard students receive some sort of financial assistance from the university. According to Stanford University’s financial aid website, the school will cover the tuition of a student with a family income of less than $125,000 and will also consider higher family incomes if another family member is enrolled in college.

The Universities of California (UC) offer affordable and quality education for California residents, but with increasing competition, not all qualified high schoolers can gain admittance to the UC system. For the 2015-16 school year, UC tuition was $12,240 across campuses.

Out-of-state and more obscure colleges, such as Berea College in Berea, Kentucky, with a tuition of $870 and Brigham Young University with a tuition of $5,150, allow low-income students to receive a quality college education for less. Berea is ranked No. 67 in US News

Report’s top national liberal arts colleges, while Brigham is tied in No. 66 in US News Report’s rankings of national colleges.

To stay competitive, the University of Southern California (USC), reduces its expensive tuition of $51,442 by awarding many of its undergraduates generous merit-based scholarships, a feature that attracts many to attend.

Class of 2015 alumnus Devin Zhao received a half-ride Presidential Scholar scholarship to USC for being a National Merit Scholar and said it “played a huge role in deciding between USC and a UC.” He believes that the over $50,000 cost is “entirely justified” by the quality of education a student can receive at USC.

Similarly, Class of 2015 alumna, Maya Ravichandran, who also attends USC for computer science, said the half scholarship USC offered her was one of the biggest reasons she chose to attend.

“Regardless of how amazing a school is, the price will always be a factor in any decision. Tuition is going up in every school, and if there is way I can soften the burden, I will take it,” Ravichandran said. “But that also was not the only factor. I love the atmosphere at USC and the resources and people I've met are amazing. Pretty much everyone will offer help if you need it.”

English teacher Suzanne Herzman hopes all students find college a time of personal discovery and intellectual growth, just as she did as an undergrad at NYU (New York University), where she double majored in Art History and French. Herzman said that though NYU’s tuition was pricey compared to other colleges, she easily paid the tuition through scholarships and a university job.

Because a surplus of jobs was available in the economy during that time, Herzman had the freedom to explore majors she did not necessarily want to pursue a career in, but still left college with the skills and tools to succeed.

“I believe so strongly in that time to continue to learn how to think, to figure out who you are,” Herzman said. “I know that’s not practical. But if you learn how to learn, if you haven’t figured out how to encounter and deal with the world, it doesn’t matter [what] career you go into.”

For many Saratoga students and families, the price of a college, no matter the prestige, still remains a factor in their decision, though faculty to student ratio, as well as return on investment, are also key determinants. Scholarships, whether need-based or merit-based, can always help, but colleges have a limited number to give out. In the end, families may ask themselves: Is the price of an Ivy League education worth four high-priced Lexuses?