Financial literacy is becoming more relevant than ever, with 85% of high school students saying they want to learn about financial literacy in school and a new semester-long financial literacy course that will be required for high school graduation in the state by 2030-31.

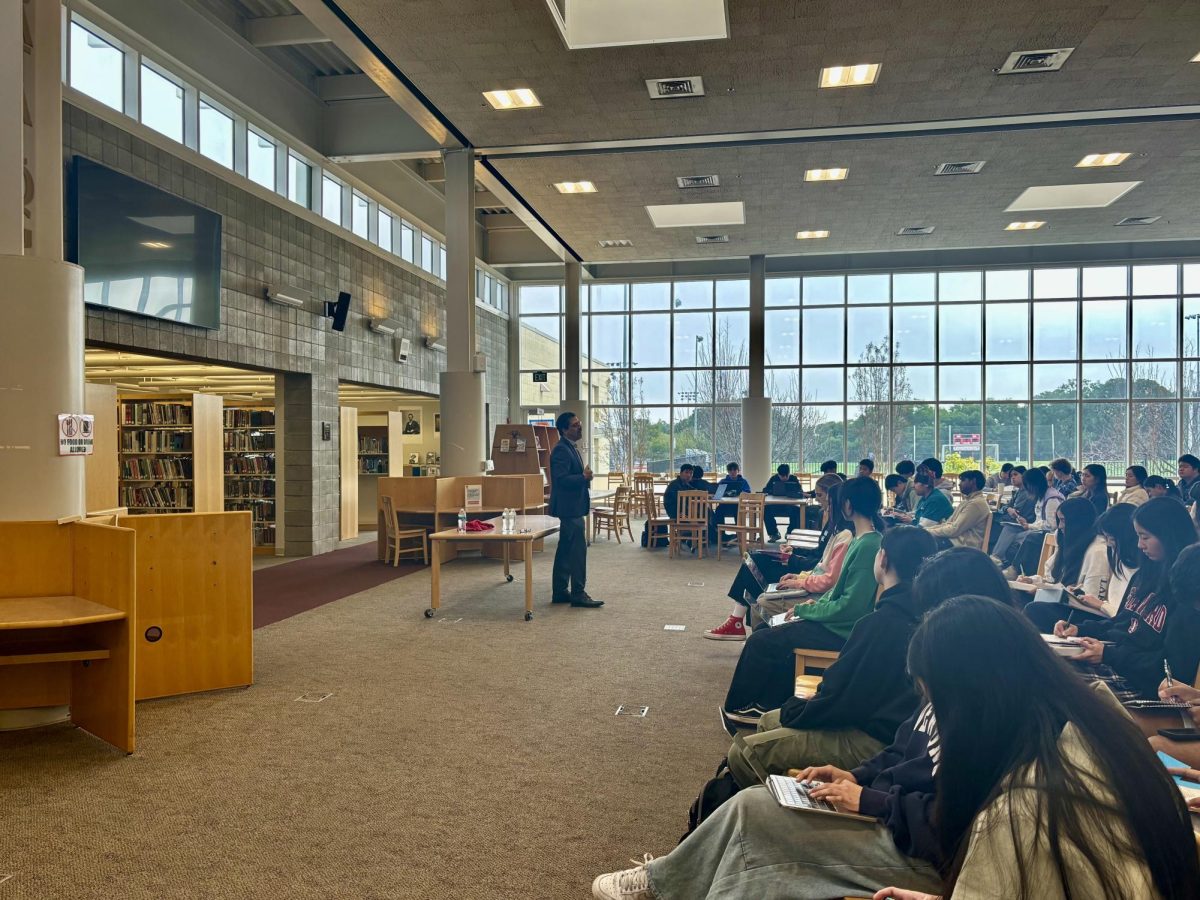

History teacher Kirk Abe’s AP United States Government and Politics class is improving students’ financial literacy with a hands-on stock simulation. It allows students to practice investing in the live market — without risking real money.

The trade practice is especially relevant since 62% of American adults hold stock, with the top 1% representing 50% of the market. The number has jumped 7% just over the last 10 years.

“I host the project to teach students about their future personal savings portfolio, the concepts of active versus passive earnings, short-term versus long-term investments, diversification and market dynamics” Abe said.

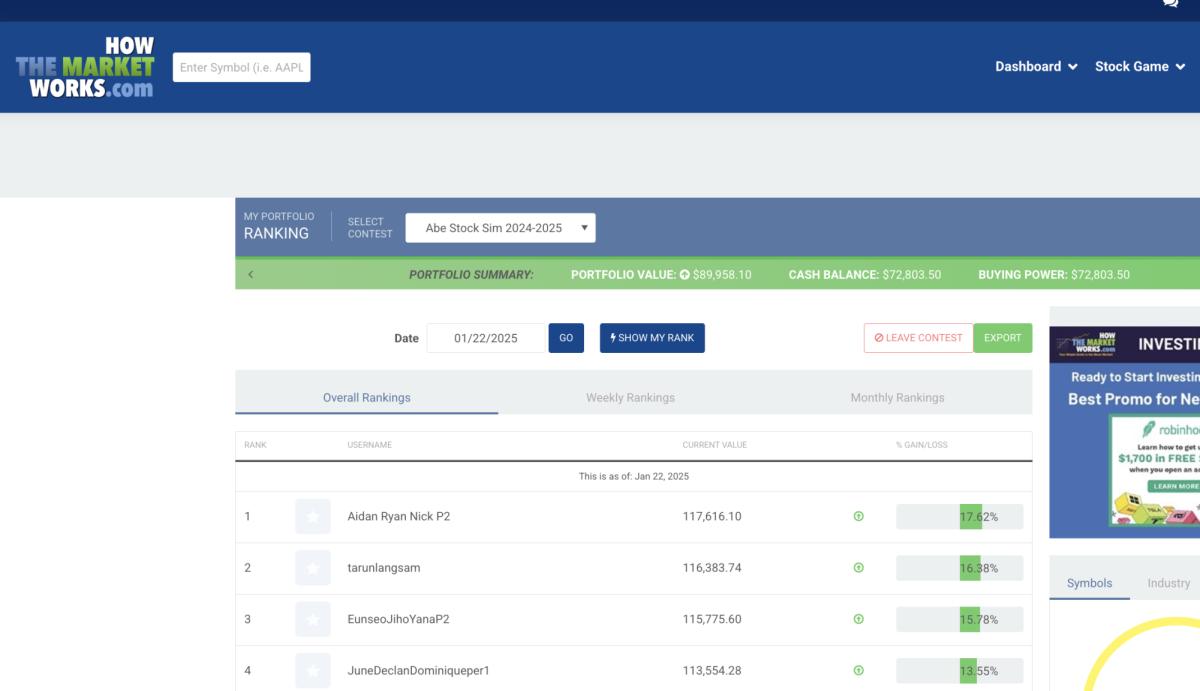

The stock project is hosted on the How the Market Works website, and has been a part of his curriculum for the past decade. The website replicates the S&P 500, the benchmark index for investing success.

The project kicks off mid-first semester (the Economics semester for seniors) and finishes at the end of the school year. Students are grouped into teams of 2-3 and work together to determine the most effective trades they can make. The top team earns a prize at the end of the simulation.

Currently, seniors Ryan Heshmati, Aidan Smith and Nick Okada stand at the top, with a 12% gain on the initial 100,000 each team started with. Heshmati specifically has ample experience investing in the S&P 500, thanks to his early exposure to the market in elementary school, and his leadership of the Investment Club.

One drawback of the simulation is that it only practices short-term investment, where many purchases investors make in the real world are focused on long-term growth.

“In real life, I don’t trade,” Heshmati said. “I just buy. My investments are focused on long-term sustainability.”

Several students are also using the simulation as an opportunity to take risks they wouldn’t otherwise have taken in real life.

“It’s a stock simulation, so, for fun, I decided to go all in on one stock, which ended up being a BioTech company,” senior Travis Zhu said.

Zhu has had one of the more volatile stock profiles, because of his resolution to go “all in” on Celularity Inc.

Ultimately, because the simulation is focused on the short-term, luck tends to play a big role in determining the rankings. The volatility of the markets mirrors real life, so students are incentivised to research their investments before deciding to add it to their portfolios.

Despite some of the drawbacks of the simulation, it’s still a valid tool to teach students about their personal savings portfolios and the strategies for gaining passive earnings.

“The project has helped me understand how stocks are priced and what factors affect their valuations,” Zhu said. “I plan to do more research in the future into specific stocks that are good investments.”