Over 85% of students receive financial aid for colleges, most of them in households below the $48,000 income line. In 2022, $140.6 billion of grant aid and $94.7 billion of loans were distributed to students.

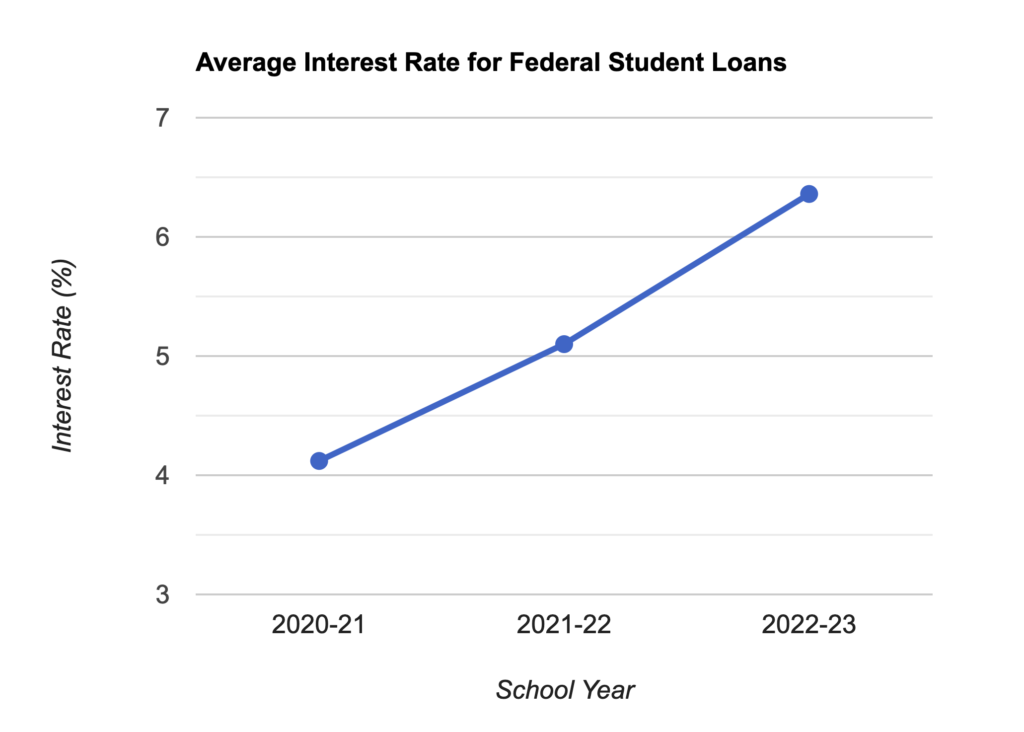

These loans need to be paid back. While federal student loans interest rates were temporarily paused during the pandemic, those rates have since increased from an average of 4.12% to 6.36% in the 2022-2023 school year.

Merit scholarships offer another opportunity for struggling students to attend college, as increased rates on need-based loans have taken a toll on low and middle-income students going to college.

With recent inflation and rising tuition, low-income households are struggling to shoulder the financial costs of going to college because need-based aid needs to be paid back and isn’t enough for a household to securely afford college tuition.

In other cases, students — up to a million across the nation — are turned away from high sticker prices they see, so they never apply for financial aid in the first place. For example, students seeing a $30,000 tuition at face value may think their family would never be able to afford it and subsequently not apply for the financial aid that may have succeeded in getting them through the cost.

Another group of students suffering from the current aid system are middle-income students who reside in the so-called gray-zone. These students have a family income sufficient enough to not receive need-based aid, but will still be heavily impacted by out-of-pocket college costs, potentially leading to significant debt.

The average cost for college tuition and other college-related expenses is $35,551 per year, with $19,020 coming from tuition alone. This is problematic for middle-income families as government aid is on a sliding scale, so higher-income families will receive less aid.

For example, a household with an income of $80,000 would receive some financial aid, but not all of it would be covered. They would have to spend anywhere from 10% to 20% of their income for tuition, a significant amount that would leave some middle-income families not far off from the financial conditions of low-income families.

These families are often forced to turn to private loans, which charge a high interest rate that usually ranges from 5% to 15% and can significantly damage their financial future.

As a result, many students who display academic excellence and intellectual promise can’t reach their full potential due to excessive financial costs.

Another important factor that comes into play is social mobility. Because merit-based aid doesn’t need to be paid back, it provides a better platform for students to rise based on their skills and knowledge rather than their parents’ wealth or zip code.

Moreover, the current college admissions process is far from equitable, and although merit scholarships are not a panacea for these pervading economic issues, they help level the playing field for low- to middle-income students.

Colleges seek out students with a willingness and a capacity to learn, and many of these students come from low and middle-income families. Merit scholarships offer a solution — they allow colleges to selectively pay the costs for students demonstrating sufficient learning ability.

Even so, opponents of merit scholarships point out that these grants mostly serve to benefit the wealthy, as the wealthy have greater access to a wide array of resources and programs.

They cite merit scholarships that disproportionately favor higher-income students. However, there are many merit scholarships exclusively available to low and middle income families that are equitable and allow these families to shoulder the financial costs of college.

For example, the Hagan Scholarship is a merit based scholarship given specifically to low and middle-income students with a household salary under $85,000. The scholarship has supported over 3,000 students in the past 12 years. With more similar programs, many students would be able to afford the high-quality education they deserve.

Although these efforts are beneficial, more action needs to be taken to make merit scholarships more equitable. As of now, merit scholarships are not perfect, but they do provide significant benefits for students. A study conducted by the University of Nebraska found that low-income students who received merit aid were 8.4% more likely to receive a bachelor’s degree than those who did not receive any merit-based boost.

Holistically, these scholarships offer an opportunity for low- and middle-income households to apply and attend college without worrying about piling up a lifetime of subsequent debt. It creates the next step in reducing college inequality and kickstarts a worthwhile investment into society’s future.