A normal day for the Siena Bistro, owned and operated by sophomore Samantha Wiesner’s family, would showcase a bustling environment as customers order from the wide variety of Mediterranean cuisine. Following the COVID-19 pandemic, however, the restaurant, which is located in Willow Glen, had to shift to takeout and delivery and is struggling to survive.

“Customers tell us every day they miss being able to come in and eat at the restaurant,” Wiesner said. “Takeout has forced a strange interaction with our customers that we’re not used to.”

This stressful time has affected everyone in a variety of ways, but so far the pandemic has hit many small businesses especially hard.

According to the Washington Post, economists project that over 100,000 small businesses have shut down permanently since the coronavirus pandemic escalation in March. Economists also predict that this may be a start to further moving the economy away from small businesses entirely to large businesses.

Like the Siena Bistro, many local businesses are struggling to stay successful during this tough time.

The federal disaster loan program, which is known as the Economic Injury Disaster Loan program, was flooded with requests. This program started as a part of an emergency system created by the Small Business Administration (SBA), which is run and funded by the U.S. government. The loan program has historically helped businesses following natural disasters and focuses on providing direct monetary aid so businesses do not have to go through the process of a lender.

The SBA has given out loans to 4.2 million businesses, but that is still just a fraction of the 30 million small businesses in the nation.

Because of the pandemic, the disaster loan program has been overwhelmed by requests. Huntington Bank, the largest SBA lender, reported receiving 16,000 loan requests on the weekend of April 4-5, according to ABC News. In 2019, the bank received 35,000 loan applications.

The program is supposed to give out loans up to $2 million, but SBA recently capped the maximum amount at $15,000 per borrower.

With businesses unable to pay rent or cover their costs during this time, a survey conducted by researchers at Harvard University, Harvard Business School, the University of Chicago, and the University of Illinois show that 2% of small businesses have closed permanently. The number for restaurants is even higher, coming out to be 3% of restaurants that have closed permanently with this pandemic.

Given that it is unclear when this pandemic ends, even if restaurants open, they will still be required to operate at a reduced capacity due to social distancing.

Particularly in the Silicon Valley, many citizens and local companies have taken it upon themselves to help businesses due to the lack of effective assistance from the federal government.

Facebook announced that it would give small businesses in the Bay Area grants totaling up to $15 million. This is part of a $100 million world-wide investment in 30,000 small businesses affected by coronavirus.

The company’s program will mainly focus on businesses that Facebook deems to be in dire threat from the outbreak. According to a statement by Facebook’s global chief diversity officer Maxine Williams, the program will also set aside half of the grants for businesses owned by minorities, women and veterans, groups disproportionately impacted by the economic effects of the pandemic.

The company released applications during the last week of April, and the application period was open for two weeks. Bay Area businesses receiving grants will receive the money within a month of applying. The application period has now closed, and Facebook is not accepting any more applications.

Wiesner and her family have owned the Siena Bistro for 12 years now, but they have been forced to seriously adjust the way they operate in light of the pandemic.

“My family has been under a lot of stress, but we’ve been really focused on keeping the business going,” Wiesner said. To ease some of the stress, Wiesner and her mom have started working with Wiesner’s father at the restaurant every evening.

Wiesner and her family have seen fewer orders in general, but their loyal clientele has remained the same.

Senior Vivienne Nguyen’s family owns and operates the Pho Ha Noi restaurants in Cupertino and San Jose. They have owned the San Jose restaurant for three years, and they opened the Cupertino branch less than a year ago. During the pandemic, the restaurants are offering delivery services and takeout.

In hopes of helping those affected by the pandemic, Nguyen came up with an idea to help out local hospitals.

“I didn’t want to sit at home and do nothing, so I brought the idea to my parents to reach out to hospitals to donate meals,” Nguyen said.

The restaurant has a team of five or six people working on the meals, and they donate about 900-1000 meals a week. Because each meal costs roughly $8 to make, the restaurant has collected a good sum of donations to cover the costs.

During this time, Nguyen’s family has been coping because their landlords decreased the rent for their locations, and they cut down hours for their workers.

“We aren’t losing money, but we aren’t necessarily making any money,” Nguyen said.

She added that racism has also played a role in decreasing business for Asian restaurants because those who “are victim to ignorance” blame Asians for the pandemic.

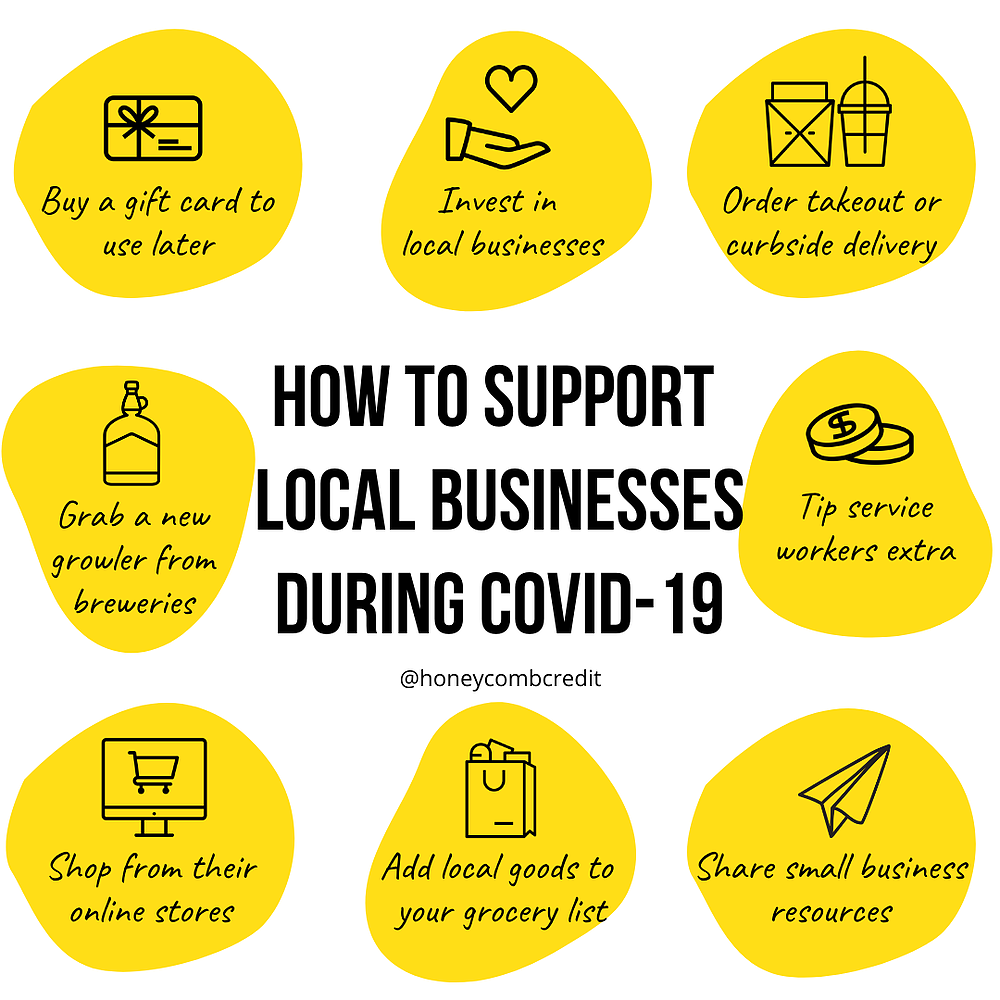

Many Saratoga citizens are trying to do their part to support their local businesses by ordering takeout. Sophomore Cheryl Wu’s family purchases takeout as a break from cooking or when they want different cuisines, and they buy from Saratoga businesses such as Hong’s Gourmet and Bai Tong.

“I actually find takeout exhilarating because it’s one of the few times we go outside, and we get delicious food,” Wu said.

Wu’s family said they empathize with the difficulty that many restaurants and businesses are going through during this time and hope that by being a customer, they can help, if only just a little.

“We order takeout not just because it’s delicious, but so that we can do our part in helping local businesses,” Wu said.