Two activities on campus this semester — one by a club and one within class — have students studying stocks and making bets on which ones will increase in price.

Both the Youth Economics Initiative and Kirk Abe’s AP Government and Economics class use stock market simulations to teach teams what it’s like to invest in businesses where the outcome is not certain. The competitions teach teams how to take risks and analyze markets to make the most strategic decisions.

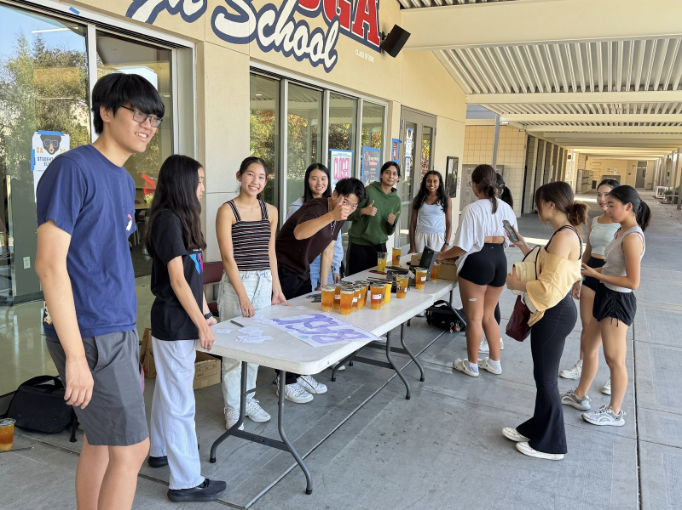

The Youth Economics Initiative club, previously known as the Economics Club, has joined the Knowledge @ Wharton High School (KWHS) investment competition. In the contest, teams of four to seven develop an investment strategy within 10 weeks to create a stock market portfolio that emphasizes both long-term gains and short-term investments.

At the five-week mark, each team needs to send in a mid-project review of their strategy, and at 10 weeks, each team will need to submit a final project report of seven to 13 pages.

Junior Henry Weng, the club’s president, said that as of Nov. 8, his team was placed 35th out of about 800 teams nationally. They’re researching companies and looking at indicators and graphs to direct their purchases of a stock.

Another participant, sophomore Dhruv Singh, said he primarily looks at the third quarter (July, August, and September) earnings for each company to make bets on how it will perform. He describes himself as a risk taker when it comes to placing bets during the simulation.

“Recently I invested in Regeneron Pharmaceuticals, and they did well in quarter three, so I ended up with $5,000 in profit,” Singh said.

While based on the same principles, the goal of Abe’s competition is a little different. While the KWHS competition focuses purely on developing a strong strategy, Abe’s competition also focuses on coming out with the most money. The grand prize for the winning team is a lunch with Abe.

Senior Jolyn Tran is participating in the competition with seniors Alex Wang and Kevin Sze. Their team strategy is to “try to go for companies that are dipping more, and [they] hope that they’ll have a better incline later on.”

However, Tran’s strategy comes with many risks. The market is constantly fluctuating, and Tran said they have to constantly think about the market’s instability when making their decisions.

Because of the project, Tran and her team learned that investing is hard and stressful and that even stable businesses can have fluctuating stocks.

Both competitions have taught their participants how to take risks and keep up with economics around the globe. Regardless of if the teams win or not, they will come out with valuable skills to take with them for the rest of their lives.

“I’ve definitely become more invested in current events that are happening, and seeing how they affect the stock market,” Weng said.