In May 2011, 73 percent of voters in the Los Gatos-Saratoga Union High School District passed Measure A, an annual parcel tax of $49 on each parcel of real estate designed to support the district’s top-quality public education and protect students from state budget cuts.

This locally controlled source of funding, which cannot be taken by the state, is set to expire in the 2016-2017 school year. The school board is placing a measure to renew the parcel tax for five years on the ballot in May.

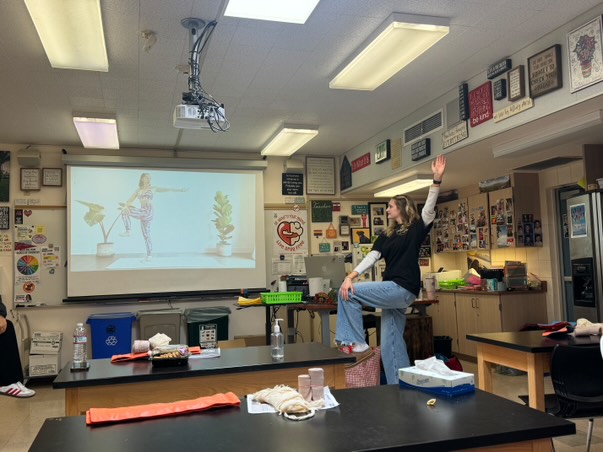

The broad purpose of Measure A, according to the district, is to “protect the local tradition of academic excellence.” Its explicit objectives are to maintain low class sizes and core academic programs, attract and retain highly qualified teachers, offer students college and career preparation programs and provide classroom materials such as textbooks and science laboratory equipment.

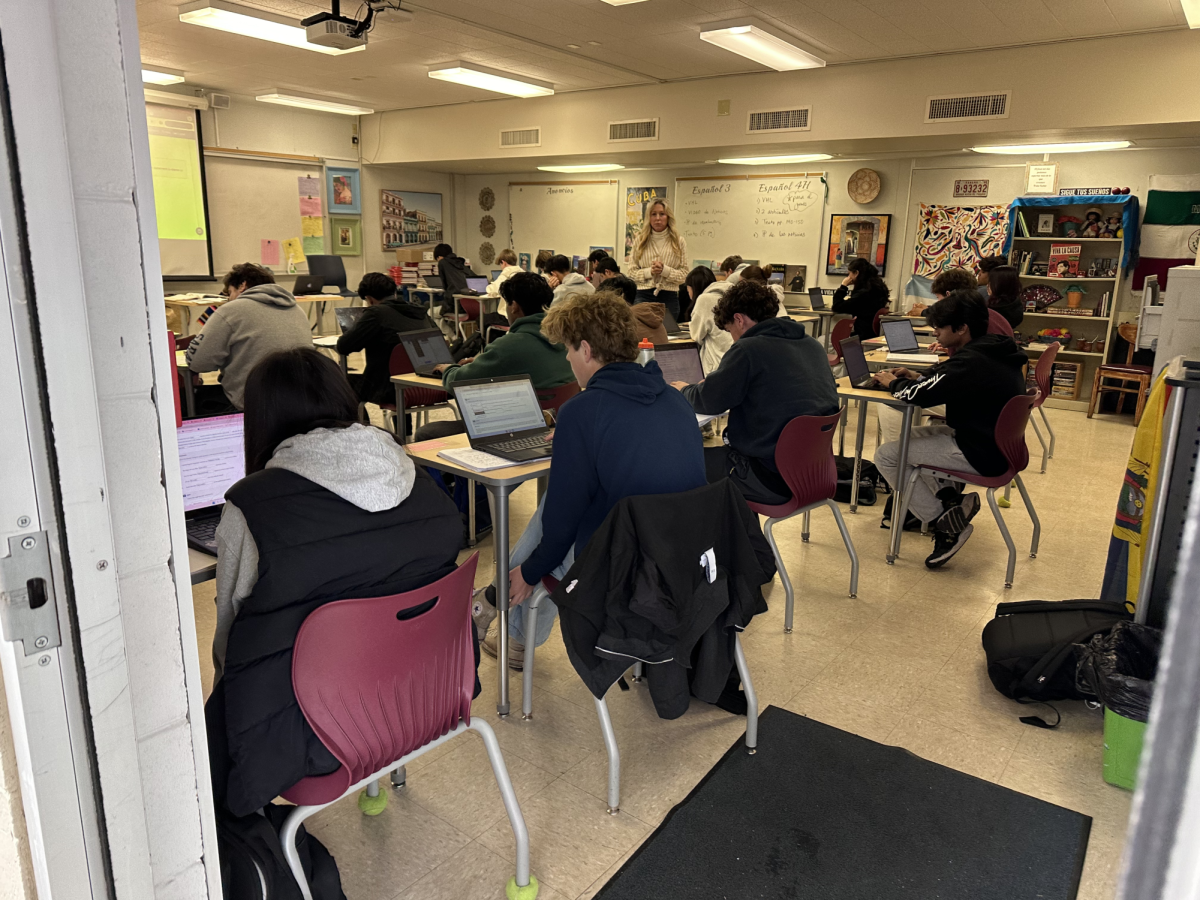

According to principal Paul Robinson, the parcel tax has been most useful in funding the school’s staffing and ability to offer a wide range of courses.

“During the time of economic struggles in the state, the parcel tax allowed for teachers to keep their positions and for schools to have reasonable class sizes,” Robinson said. “It has allowed us to continue that trend when the economy turned around, and maintain excellent class sizes for our students.”

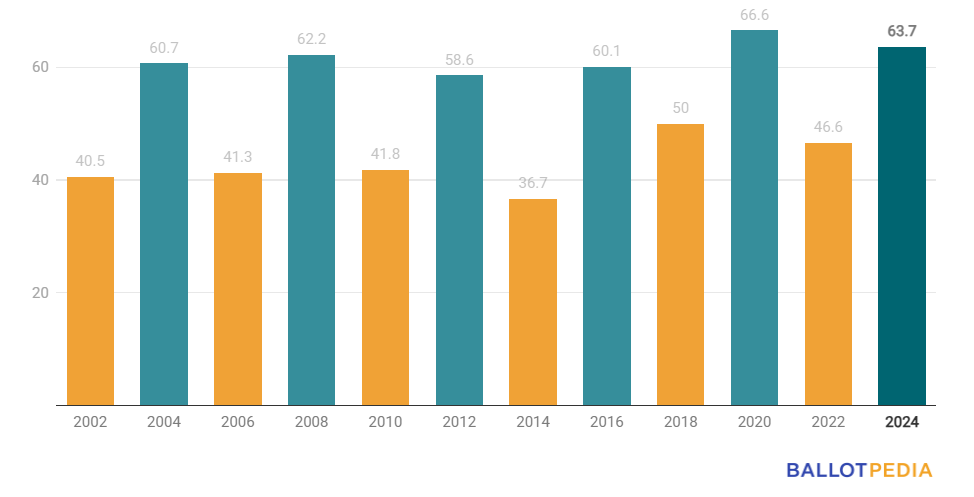

For renewal, the parcel tax requires a 66.7 percent majority. In the event that it is not renewed, the school district will lose almost $1 million in funding annually, and according to Robinson, the result of a failed parcel tax would likely be fewer course offerings and bigger class sizes. It might also mean the school couldn’t employ as many teachers.

Not every citizen in the district must pay the parcel tax: Senior citizen homeowners, aged 65 and older, can apply for exemption from the tax. As with the original measure, a Measure A renewal would include strict fiscal accountability provisions. By law, all parcel tax funds are to be spent exclusively for educational improvements at the district’s two high schools, not for other purposes like administrators’ salaries.

The Parcel Tax Oversight Committee (PTOC) was established in May of 2012 to review expenditure reports and ensure parcel tax proceeds are spent for the purposes stipulated by the measure.

The PTOC, which comprises Shirley Cantu of the Senior Citizen Group, Roger Mason of the Chamber of Commerce, Terry Zaccone of the League of Women Voters, and community members Stephen Beck, Mark Weiner, and Joanie Silberstein, presented their latest annual report to the Board of Trustees on Nov. 17. They found that Measure A funds for the 2014-2015 year were spent in accordance with the purposes of the parcel tax measure.

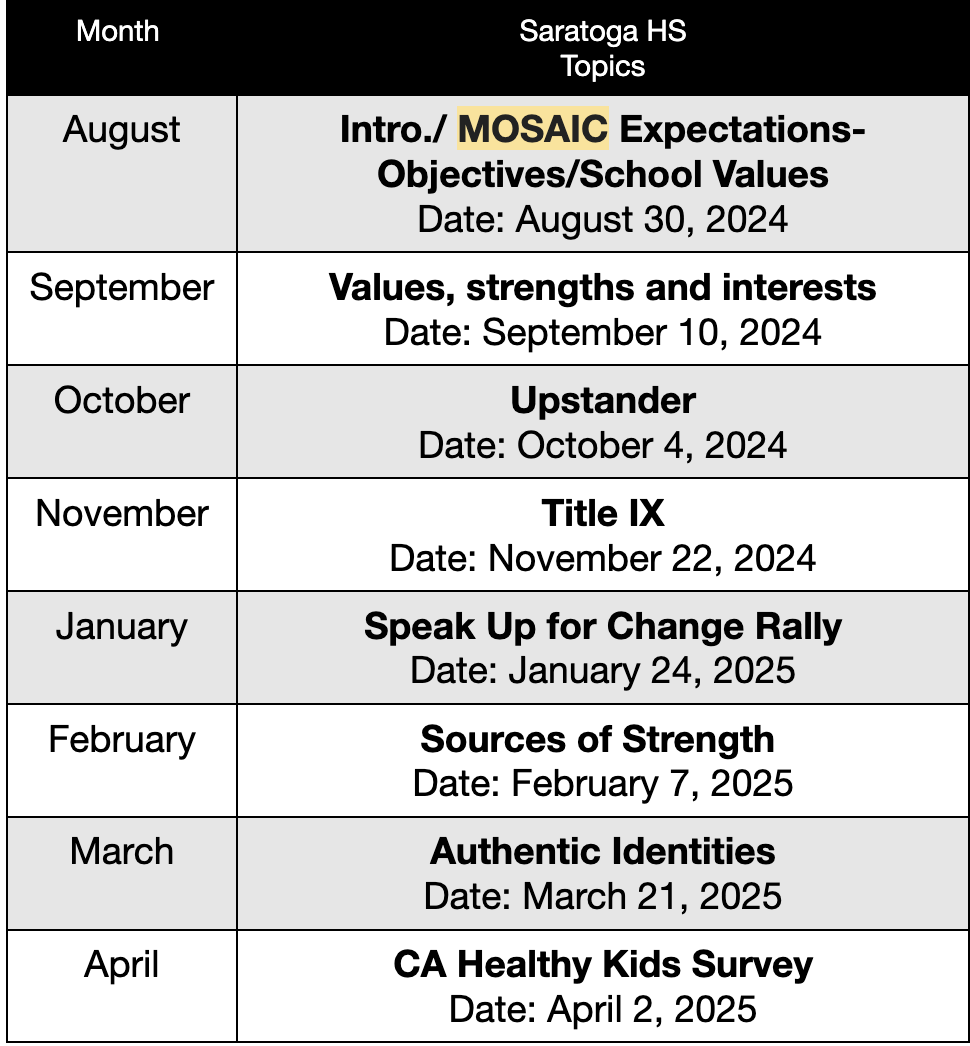

According to the PTOC’s 2014-2015 Parcel Tax Expenditures Report, the total amount collected by the parcel tax was $974, 230. Approximately 2 percent of this amount went to covering the costs for administering the collections of the tax as well as reimbursements issued to senior property owners exempt from paying the parcel tax.

The emphasis for the 2014-2015 parcel tax was to improve core academic programs such as math, science and English, especially at the ninth grade level, by lowering class sizes and increasing the number of highly qualified teachers who are full time employees (FTE). The 2014-2015 parcel tax funded a total of 9.6 Certified Full Time Employeed (FTE), 5.2 FTE at Los Gatos High and 4.4 FTE at Saratoga High. This included 4.2 FTE for ninth grade English and math teachers between the two high schools. Through Measure A, an additional 5.4 FTE were distributed among science, foreign language and art teachers.

According to Robinson, some of the most vocal supporters of Measure A have recently withdrawn their efforts to renew the parcel tax because of their disapproval of the district’s move to a new bell schedule.

“It’s a shame that someone would hold the parcel tax hostage because they are philosophically opposed to change,” Robinson said. “Ultimately, this hurts students and the desires they have to pursue learning in the future. I hope that by the time it comes to vote on the renewal, everyone would see the advantages that the parcel tax brings to our schools.”