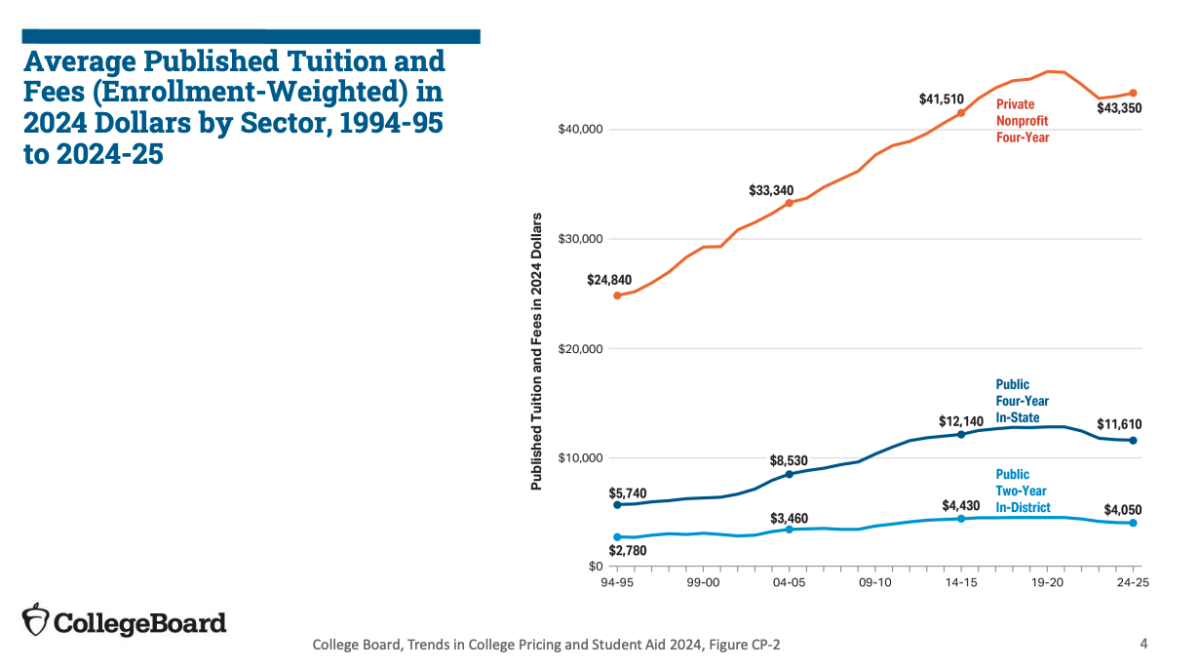

Fifty-one percent of college undergraduates finish (or don’t finish) college with student loan debt, and these loans are the second-largest type of consumer-generated debt.

As more Americans face this crisis, attending college or university has slowly grown unappealing and inaccessible for many aspiring families, with a 2024 survey by Business Insider finding that only 46% of Generation Z (those born between 1997 and 2012) believe that attending college is worth the steep cost.

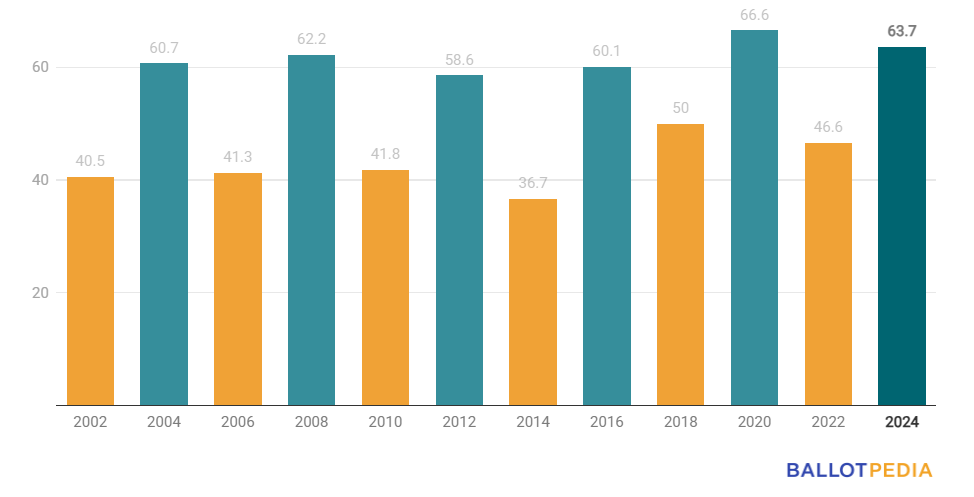

This decline in enthusiasm for higher education has contributed to a decrease in college enrollment. The total number of undergraduates has fallen 15 percent since 2011, according to the Department of Education.

Meanwhile, to keep their bottom lines healthy, colleges have been admitting a higher percentage of students. From 2012 to 2022, these rates rose an average of 7.6% across American universities. While this may balance the number of college acceptances, the high number of students choosing to forgo a higher education due to cost can’t be amended without fixing the root of the issue — the steep financial barriers themselves.

Recently, some top-notch private and public institutions — such as Massachusetts Institute of Technology (MIT), Harvard University and all nine academic colleges in the University of Texas System — announced that, starting in the fall, tuition would be free for undergraduates meeting specific family income requirements.

The threshold of the requirements varies between institutions, with MIT and Harvard setting the highest threshold of $200,000. Although not all of the requirements may help students in high-income Silicon Valley, these changes mark a historic step in combating tuition debt, paving the path for other institutions to initiate similar programs.

For private and public universities, which accounted for over 60% of all U.S. postsecondary institutions in 2021, tuition accounts for only 16% to 19% of total revenue. In 2023, only 9% of MIT’s revenue was from tuition and less than 13% of Harvard’s revenue was from tuition, which allowed the schools to additionally cover housing, dining, fees and an allowance for books and personal expenses for families earning less than $100,000.

About 80% of American families come from families who earn less than $200,000 annually, while 50% of families meet criteria that allow them to receive partiall aid.

What exactly does this mean for households here? In 2023, about 40% of households in Saratoga had an income less than $200,000. Although we live in an affluent area, at least some students here could possibly fall under MIT and Harvard’s free tuition requirements, meaning that they would be able to attend MIT or Harvard for at least $60,000 less each year.

Changes, similar to those in MIT and Harvard, have also been implemented across other private universities like Carnegie Mellon University, St. John’s College and Brandeis University, which announced undergraduates with a family income under $75,000 will be eligible for free tuition starting in an upcoming year.

Public universities have also started to take steps to alleviate student debt. In all nine academic universities under the University of Texas (UT) System, starting in the 2025-26 school year, they will all cover tuition for students who are Texas residents, enrolled full-time in undergraduate programs, applied for applicable federal and state financial aid and have family income of under $100,000.

These recent changes are a strong first step for institutions to lower the financial barriers that hinders several from accessing higher education. Statistically, minorities tend to have a lower family income, allowing them to benefit more from this change. Now that affirmative action has ended, this allows institutions to increase their diversity.

While there isn’t enough data to conclude the benefits of these announcements, students should enroll in these universities at greater numbers due the financial incentives, convincing other institutions to follow suit. However, students and parents must be careful of where the money for free tuition comes from given the saying “there is no such thing as a free lunch.” If the money comes from the taxpayers, then there aren’t really benefits to free tuition.

Free tuition allows for students who are less fortunate to receive higher education, diversifying perspectives on campuses all over the U.S. and creating a welcoming atmosphere for everyone — so it’s crucial for universities to prioritize affordability, ensuring that financial barriers no longer stand in the way of future graduates who will pay back the cost of their education many times over in their careers.