On an evening in 1947 at a lab in Murray Hill, New Jersey, the Nobel Prize award-winning William Shockley first created the basic transistor switch. Today, such transistors can be found in all areas of life: in your schoolwork-packed laptops and even your dishwasher. A single iPhone 16 has 16 billion transistors, and iPhone 17 will have 19 million. The industry, as of 2021, employed over 2 million skilled workers around the globe and has been the base of exponential technological growth.

As semiconductors become increasingly important in almost all technology and more and more jobs depend on them, it’s important to understand why U.S. production of the product is critical.

The status quo: high reliance on semiconductor supply

Semiconductors alone contribute $246.4 billion to U.S. GDP each year and offer about 277,000 jobs in the tech industry. In this market, though, the U.S. now holds a surprisingly small share of production at only 8% of the world’s supply, whereas 83% of total manufacturing happens in Asian countries including Taiwan, China, South Korea and Japan.

Essentially, semiconductors are materials which fall between the functionality of a conductor and an insulator. They are composed of pure elements and through a process called doping, where impurities are gradually added to change the conductivity of the substance.

Besides manufacturers’ reliance on semiconductors to power everyday items, these materials are also essential in military systems, transportation, computing and health care. For these reasons, there is a massive global race to secure the best semiconductor technology as fast as possible, and many of the leading foreign companies are heavily subsidized by their governments, unlike the U.S., which, until recently, largely left them alone.

Resource advantages in the East

One primary reason for the U.S. lag in semiconductor technology is the lack of resources dedicated to producing and manufacturing chips. The U.S. currently leads in semiconductor design, but is outsourcing these designs to be produced in China and Taiwan. To speed up production, Congress passed, and President Biden signed into law, the CHIPS and Science Act in 2022, which provided $39 billion in subsidies for semiconductor production and $11 billion going for critical research and development.

On the other hand, Taiwan’s semiconductor industry, which accounts for 13-15% of its GDP, has doubled in value to $162.5 billion in the last four years. Taiwan Semiconductor Manufacturing Company (TSMC), the leading semiconductor manufacturer globally, even receives investment from U.S. designers to produce in Arizona. The reason the Taiwanese company has been able to flourish is partly the prevalence of key materials like gallium and germanium in the East-Asian area. This allows TSMC to produce 60% of semiconductors and 90% of advanced semiconductors globally.

IP theft by China hinders U.S. growth

China has also been catching up in the semiconductor race. In 2020, China imported more in semiconductors than it did in oil, leading the country to a $233 billion trade deficit. This massive cost to Chinese producers has incentivized them to start working toward self-sufficiency in all areas of production, which includes semiconductors. Specifically, China is passing new legislation and endorsing initiatives to boost semiconductor manufacturing.

To the U.S., China’s growth in the semiconductor industry presents an oncoming threat to global economic leadership. Since semiconductors are critical for military growth and expansion, the U.S. has been implementing a series of intellectual property (IP) controls to slow China’s growth.

In the past couple of years, the U.S. has banned chip exports to China’s military, increasingly replaced Chinese chip imports with Israeli semiconductor technology and prevented private companies from selling chip-making equipment to Chinese companies — Huawei and Semiconductor Manufacturing International Corporation (SMIC) — without a license.

There have also been increasing concerns over Chinese spies stealing semiconductor trade secrets. A study by the Center for Strategic & International Studies (CSIS) found that there have been 224 reported instances of Chinese espionage directed at the U.S. since 2000, and over 1,200 cases of intellectual property violations have led to lawsuits.

As CSIS writes, “China has added the theft of massive quantities of personal information (PII), political coercion, and influence operations, to its espionage activities” which is further slowing U.S. production and innovation.

A contrasting view is that China is merely aiming to expand its production capabilities and economic growth and with that, its foreign policy.

According to Mark Green of the Wilson Center, “Beijing argues that these restrictions are a thinly disguised effort to deny Chinese access to technologies essential for its economic growth and development, including plans to bolster its domestic semiconductor production capacity.” In response, China has restricted its exports of gallium and germanium to the U.S., materials critical to semiconductor production.

Barriers to entry

One major issue with the U.S. semiconductor industry is the substantive barriers to entry that prevent new companies from succeeding to the level that Nvidia, Broadcom, AMD, Intel, Qualcomm and other industry-leading companies have. Two of these barriers include high start-up costs and low access to capital, which the government is trying to counter with increased subsidies.

“Reshoring semiconductor manufacturing could improve the quality of life for millions of Americans who would now experience the benefits of economic growth and technological progress,” said senior Ashish Goswami, who has plans to study economics in college.

AI’s influence on semiconductors

As AI becomes more mainstream, semiconductors are facing growing demand. Primarily, Nvidia has used AI to expand the power of its graphics processor units (GPUs). With technology that speeds up simultaneous processing, these GPUs are more and more vital.

Nvidia’s GPU now dominates the gaming market, filling 80% of total market share in that area. It has seen a lot of success in this area, with stock prices surging with a growth of 262% from last year.

The GPU and the role of semiconductors in AI will be critical in determining the U.S.’ ability to create the most effective and efficient AI products and uses.

“If the U.S. gains a greater lead in AI development, it can largely influence how the technology is used in developing countries by acting as a pioneer in the area,” senior Leonardo Jia said. He has closely watched the spread of AI and plans to study business and engineering in college. “If other countries seeking to use AI for authoritarian purposes maintain a lead over the U.S., the global system will begin a shift away from democracy.”

Thus, AI development in the semiconductor industry will need to be closely monitored by the U.S. government to ensure it is used ethically and democratically.

How does this impact Silicon Valley?

Silicon Valley, well known as the “tech hub” of the nation, saw the roots of semiconductor innovation. In the tech field, Hewlett-Packard (HP) was founded at Stanford University in 1939 where they produced audio oscillators for Disney.

Most prominently, William Shockley, co-inventor of the transistor, which is a simple switch found in the millions on integrated circuits, also founded the Shockley Transistor Corporation in Palo Alto. Many of the Shockley Transistor Corporation’s employees later banded together to found Fairchild Semiconductor in 1957.

Fairchild Semiconductor, with Texas Instruments, then developed the integrated circuit, also known commonly as the “chip,” which is made largely of silicon, thus giving Silicon Valley its name. These chips were essential to the success of the Apollo program in 1969, which landed the first humans on the moon.

Famous offshoots of Fairchild Semiconductor include Intel Corporation, National Semiconductor Corporation, Advanced Micro Devices, Inc. and LSI Logic Corporation.

As semiconductors became more commonly used in day-to-day life, technical employment in Silicon Valley grew significantly. San Jose became the fastest-growing city between 1970 to 1980, and by 1989, electronics was the largest manufacturing industry in the U.S.

Besides its domestic growth, the U.S. also controlled 70% of the international market in semiconductors, a drastic drop to today’s 8% global market share.

As the industry continues to navigate through ups and downs, the impacts of all decisions made are strongly felt in the atmosphere of Silicon Valley. Advocates for the technology say actions taken by today’s government in the semiconductor industry will be critical, given that the Bay Area relies heavily on technological innovation to carry its market.

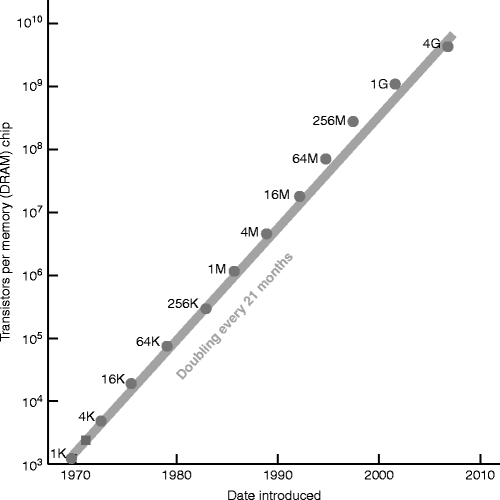

Semiconductor production and design in the Bay Area has expanded over the years. Famously, Moore’s Law, of Intel co-founder Gordon Moore, that “the number of transistors on an integrated circuit will double every two years with minimal rise in cost,” has held true.

Rather than predicting the growth of semiconductor-based technology, Moore’s Law acts as an achievable goal, and sets the industry on a trajectory that is still propelling innovation forward today.

While the U.S. is working hard to grow and match foreign production of semiconductors, advocates say it needs to truly commit to the race with greater investment. The current market shows that the U.S. is lagging far behind Taiwan and China — this may have critical implications on U.S. hegemony, which must be maintained in order to prevent international conflicts.

“History has proven that technological advancements dictate the relative geopolitical influence of each nation,” Goswami said. “Expanding American semiconductor manufacturing could bolster our allies’ confidence in America’s ability to defend, should any revisionist powers seek to challenge the current global order.”