In recent years, it’s become harder for Bay Area schools, including Saratoga High, to recruit and retain top teaching talent in such a high-cost-of-living area. At the same time, other comparable districts such as Mountain View Los Altos and Santa Clara now pay their teachers significantly higher wages than LGSUHSD.

Notably, in recent years, longtime football coach Lugo accepted the athletic director and head coach job at Mountain View School, and longtime guidance counselor Alina Satake also left for Mountain View.

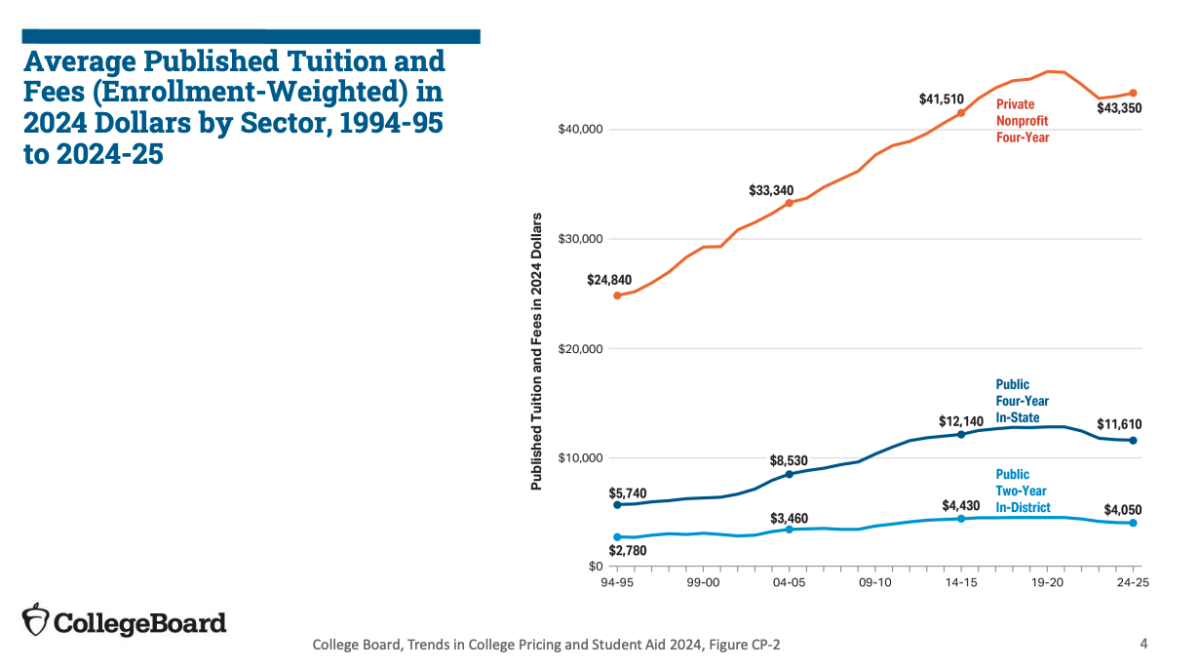

As LGSUHSD has fallen behind other nearby districts, with Mountain View having an average salary of $152,524 as of the 2023-24 school year compared to LGSUHSD’s average salary of $117,963, the Board of Trustees is considering increasing asking voters to extend and/or increase a parcel tax of LGSUHSD next year.

This measure would primarily aim to raise staff salaries in light of concerns regarding falling employee retention rates, especially among teachers.

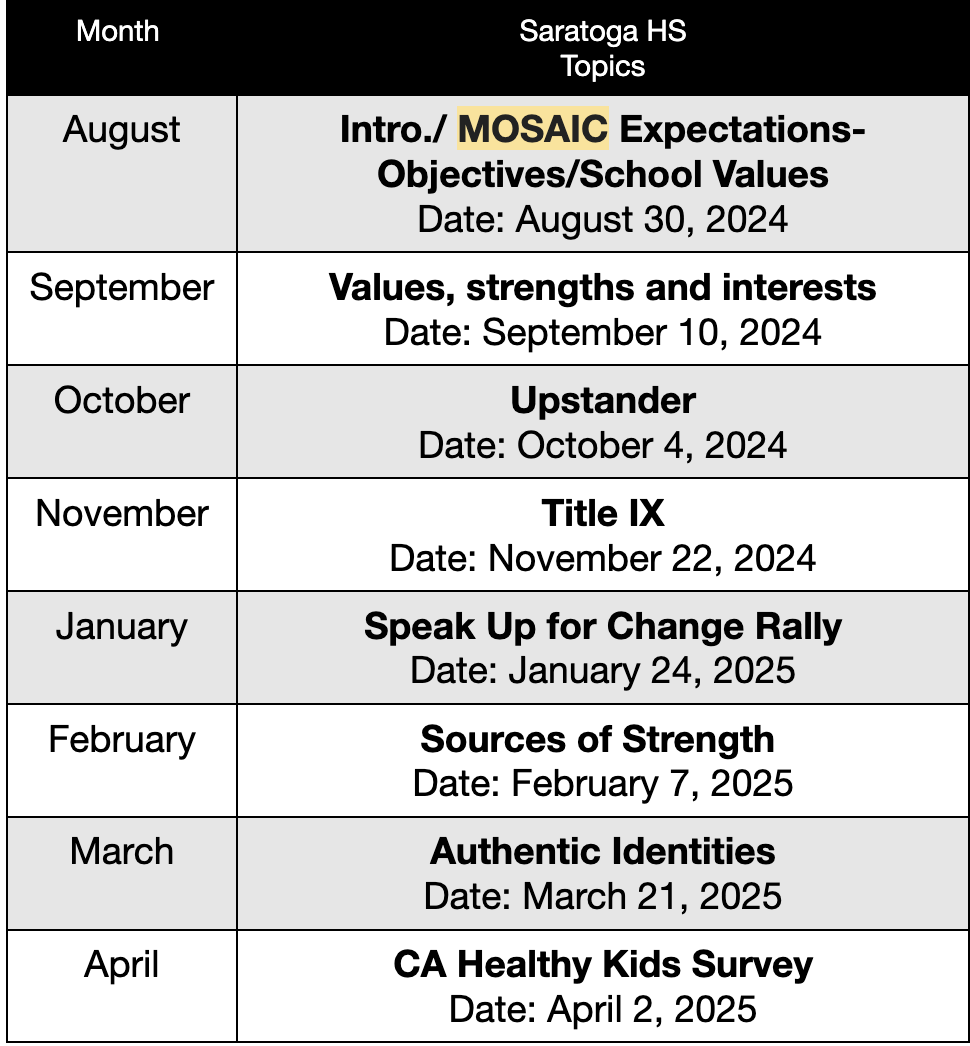

The board’s upcoming actions for the parcel tax renewal process will include these actions:

- They are creating informational materials, including parcel-tax fact sheets, FAQs, and online presentations on the benefit of the tax, and will launch an outreach campaign in November to engage registered voters and parents on budget constraints and continue stakeholder engagement through December.

- In January, the board will conduct a field tracking survey to assess renewal feasibility involving an increase in parcel tax rates. In February, the board will decide whether to run the measure as a May 2024 special election; if that deadline is infeasible, the board will instead continue community engagement until August with the hopes of having the measure on the November ballot.

The district recently paid for a survey of potential voters. The results show that while the majority of LGSUHSD voters approve of the way the Los Gatos and Saratoga High School are performing, a large number think they are already overtaxed and might not support any parcel tax increases.

A higher parcel tax — an annual tax on each parcel within a district — would help supplement the money the district gets from property taxes to pay for costs such as maintaining libraries and improving employee salaries. Currently, the district’s total budget is around $80 million with $70 million coming from the district’s property tax-funded revenue. The existing $49 parcel tax raises roughly $1 million each year for the district.

“It is our hope to be able to provide not only competitive salaries and benefits that would bring exemplary teachers to our schools but also additional incentives, such as multiple preparation periods, caring school climates as well as value and support for the professional work our staff exhibits,” district public information officer Tanya De La Cruz said.

If two-thirds of voters approve it, funds collected from a parcel tax would be managed by an oversight committee of parents and community members. Members of this committee would meet regularly to ensure that funds obtained from the parcel tax are being used for what was promised to the community in the original ballot language.

In May 2016, the current parcel tax was renewed at $49 per parcel for July 2017 through 2025, netting a total of $950,000 annually for the school district. The $49/parcel tax was first passed on May 3, 2011 district.

For comparison, the Fremont Union High School District’s parcel tax for 2022 was set at $98 per parcel, netting it $5 million annually. In addition, Saratoga Union School District, comprising Redwood Middle and Saratoga’s three elementary schools, assesses a parcel tax of $68 per parcel, $19 more per parcel than LGSUHSD.

Noting this disparity, the board hired a firm named EMC Research to conduct community polling on public perception of the district’s handling of money, favorability for a parcel tax increase to $99 and favorability for an increase to $249. The polling occurred from Sept. 13-18 via phone interviews, emails and text and was in English and Chinese.

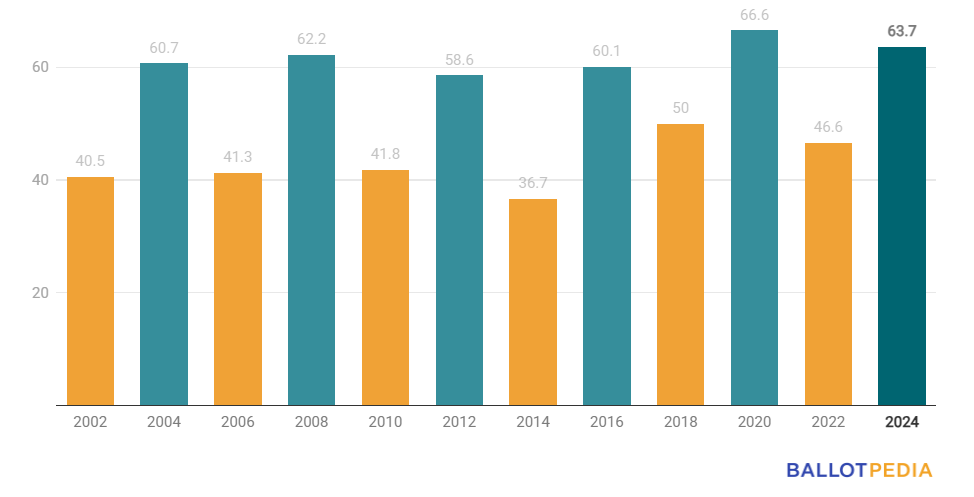

From the poll, it was discovered that 64% of voters support the $99 parcel tax renewal and 67% of voters support the $249 parcel tax renewal, meaning that overall, voters marginally support the $249 parcel tax plan over the $99 plan. Statistically, there is little difference between the support for the $99 plan and the $249 plan.

A parcel tax of $99 per parcel would generate an annual $2 million in income over the course of eight years, while a parcel tax of $249 per parcel would provide an annual $5 million over the same period.

De La Cruz also noted the board has been meeting with staff, parents, and students since last spring to launch a new strategic plan called “We INSPIRE” that will guide the district in its work in the next few years, including managing the parcel tax.

“We need to reach our vision of shaping future global leaders, and this parcel tax will help us reach that goal,” De La Cruz said.