At age 18, Class of 2021 alumnus Luca Tang became a millionaire.

His success occurred after months of observation, anxiety and fluctuating investments — the culmination of years of experience and research before taking one high-risk, high-reward play during May of 2021.

Tang began his investing journey as a high school freshman, when his parents loaned him the $10,000 he would eventually pay back. When he started taking high-risk positions without proper research to corroborate his decisions or the patience to hold through periods of price volatility, his portfolio tanked. Tang ended up losing the vast majority of this initial investment.

“It was really discouraging,” Tang said. “I was tempted to give up.”

After months of failed investments and trades, Tang developed a more systematic approach after consulting with a financial advisor. Instead of speculating, he tried to calculate the intrinsic value for companies in order to make longer-period investments, understanding the risks he took when making an investment through tracking volatility and current and upcoming company events.

This change in investment strategy paid off. Over the next three years, Tang grew his portfolio to over $200,000 through positions in financially secure technology companies with clear growth prospects such as Nvidia ($NVDA), Apple ($AAPL) and Google ($GOOGL).

The returns did not come easily: Tang’s grades and health often suffered as a result of the time he spent researching and studying the markets. His parents often locked his trading account to force him to focus on school and his grades.

“It hurt, but it was nice to take a break from the stress of investing and managing my portfolio,” Tang said.

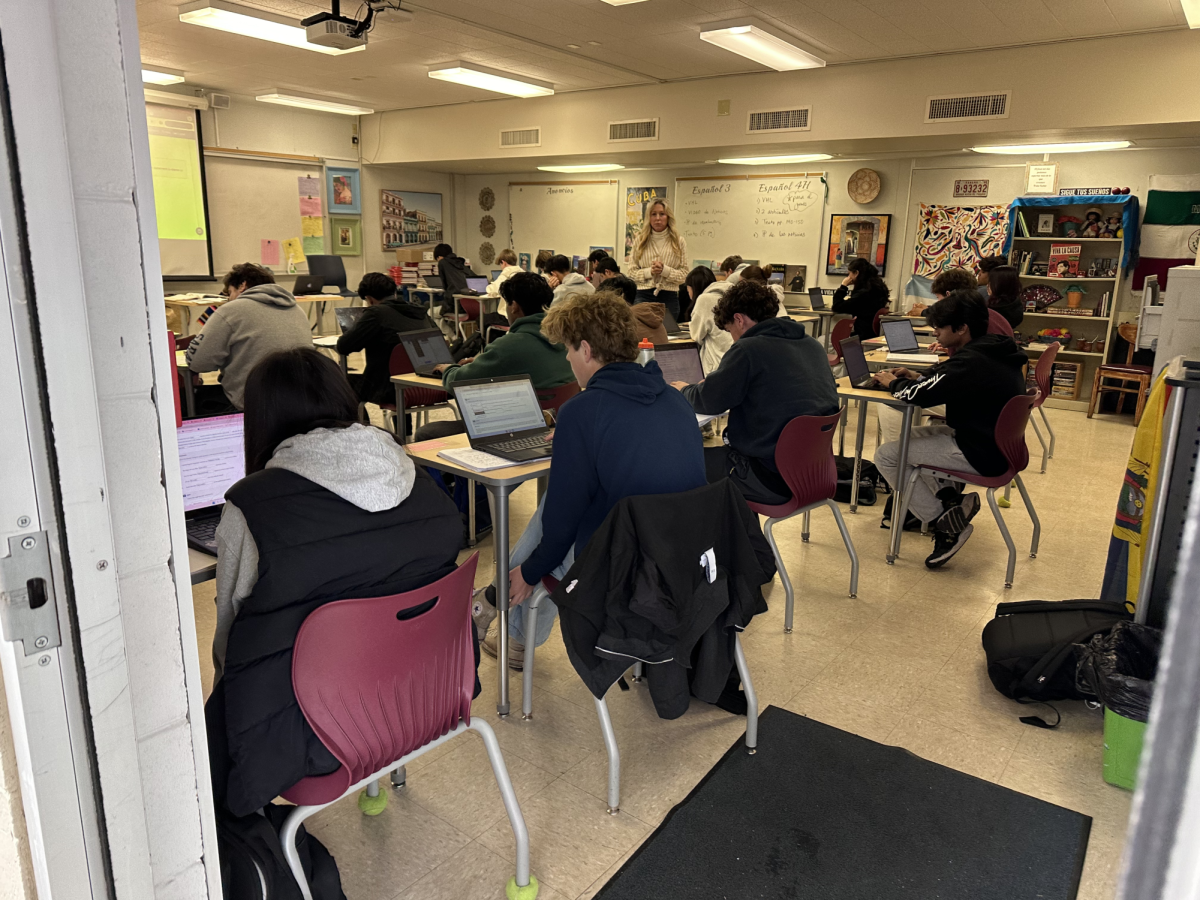

To share what he learned from his experiences, Tang co-founded the Investment Club during August of 2020 as a community for other students who were passionate about investing and wanted to gain a practical understanding of the financial markets. The club was founded initially as only a school club but has since expanded outside of Saratoga’s boundaries.

It now has over 100 members around the world, with students participating from countries as far away as Brazil and India. (Full disclosure: I am the co-president of the club.)

“I wanted to show students interested in investing that losing money in the stock market is completely normal,” Tang said. “I wanted to provide resources and a community for students to develop their strategies and work towards financial independence.”

As an active member of the club’s Discord server, Tang said that he gained valuable insights from his peers. During the previous three years, he made primarily long-term investments; the club exposed him to shorter term, higher risk trades covering assets and companies he had not been aware of previously. As a result, Tang began considering innovative companies like Tesla ($TSLA) and Palantir ($PLTR) for his portfolio.

“Although my actual positions remained relatively unchanged, the Investment Club helped me gain valuable insight on companies that I never would have heard of without it,” Tang said.

During December, one of the many stocks that was particularly popular among members of the Investment Club was GameStop ($GME). In January, Tang participated in the GameStop meme rally, an online movement that led to massive gains for retail investors and huge losses for institutional investors.

The movement started in reaction to institutionalized investors shorting GameStop. Shorting occurs when investors borrow an asset from a brokerage and sell it at its current price before buying it back under the assumption that the stock will be cheaper in the future, making the investor a profit. If, however, the stock price moves upwards, shorts potentially face unlimited losses. As a result, investors cut losses and buy back their positions at higher prices, which leads to a chain reaction of upward pressure on the stock price.

During the movement, retail investors bought GameStop stock at unprecedented levels. At one point, GameStop traded at just under $500, up nearly 20,000% from where it was at only a few months earlier. Investors who shorted GameStop ended up losing close to $2 billion in just two days as a result of the movement. The most notable investor was Melvin Capital, an investment fund that lost half of its assets under management as a result of the GameStop short squeeze.

Months later, Tang decided to do a short of his own by betting against Bitcoin — a highly risky play.

“I’d seen what shorting can do to portfolios, and that’s something I wanted to avoid at all costs,” Tang said. “But I had no doubt my play was accurate, and that Bitcoin was overvalued.”

Prior to making the trade, Tang said he had heard from friends in April closely following the Chinese financial markets that crypto purchases could potentially be banned in China.

Additionally, cryptocurrencies had risen substantially since early 2020 — with Bitcoin rising from less than $10,000 to nearly $60,000 in under a year due to a variety of reasons from widespread adoption by large companies to support by high profile individuals such as Elon Musk.

Tang predicted from Bitcoin’s previous trends and their relation to policy changes that it would fall in price. So on May 1, Tang shorted $10,000 of Bitcoin on triple leverage.

Leveraged trades seek to multiply movements in asset price, exposing the investor to higher risk and potential benefit. In this case, a $10,000 investment on triple leverage meant that if Bitcoin were to drop 1%, Tang’s position would appreciate by 3%, a $300 gain.

When the news began circulating that China would restrict purchases on Bitcoin during the second week of May, the price began dropping — Tang added more to his position as a result.

“I only add [more cash to my position] when it, in my eyes, is guaranteed to gain,” Tang said. “After Bitcoin dipped, I knew I was right.”

Over the next few days, Tang drastically increased his position, using $100,000 that he earned from previous investments to short Bitcoin at double leverage, while also making similar trades borrowing from other accounts.

In total, with a short position of around $100,000 cash and an additional $1,1 million in leverage and borrowed assets, Tang made a $1.2 million bet against Bitcoin. This meant that if Bitcoin moved up 10%, he would face losses of at least $120,000, completely wiping his initial investment.

“I’ve never felt more anxious,” Tang said. “I couldn’t afford to lose anything, and my short on Bitcoin was basically a gamble with my life savings.”

A week later, Tang’s position was up by almost half a million dollars, and on May 19, he closed his short position with a total profit of nearly $1 million. Currently, Tang has reinvested his returns into a myriad of different assets, primarily other publicly traded companies.

Tang believes that it was not particularly difficult to decide to short Bitcoin, and anyone else with the same knowledge could have made the same choice.

While he could have flaunted his success or gone on a spending spree, Tang said he prefers to stay the course, steadily building his portfolio and making safe investments.

“It’s personal,” Tang said. “I’m a pretty low-key guy about the money I make.”

Looking forward, Tang, who is attending college in the Bay Area, said he hopes to become a financial analyst after graduation. Additionally, he expects to manage the North American branch of his family’s company. Tang also plans to reinvest in publicly traded companies, as well as a myriad of other investments.

“Ultimately, this trade mostly affected how I approach and handle stressful situations,” Tang said. “It taught me to think rationally while things are looking bad.”