On Jan. 13, the financial markets saw retail investors present the single largest, most-unified front of stock market history as redditors banded together on the subreddit r/wallstreetbets (WSB) to “short-squeeze” a number of stocks. These individual investors banded together to buy hundreds of millions of dollars worth of stocks from companies like GameStop (GME), Blackberry (BB), AMC Theatres (AMC), Nokia (NOK), driving them to all-time highs.

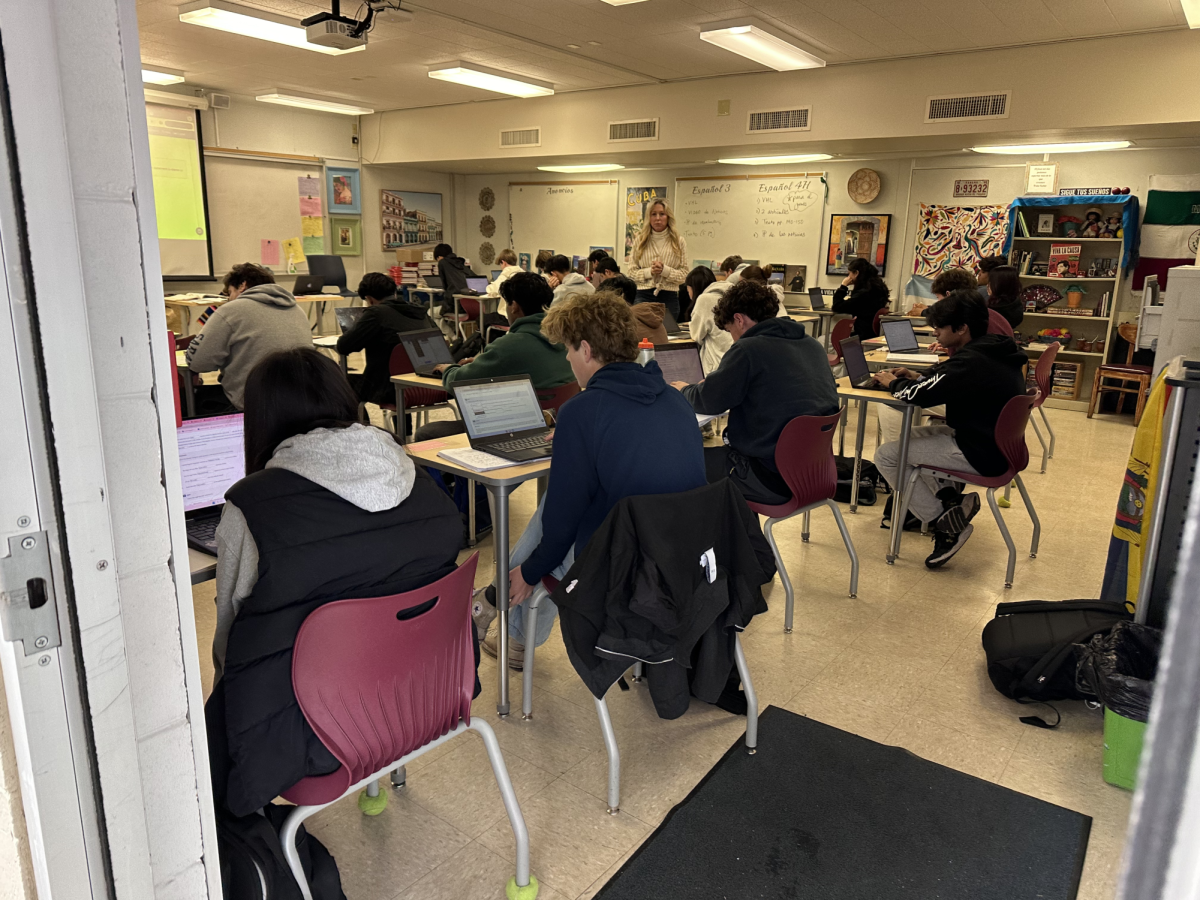

Among these redditors were a few Saratoga High students.

“I think that this is definitely a historic moment,” junior Peter Li said. “For centuries Wall Street has been dominating and manipulating the market.”

While Li invested in GME long after the start of its historic run, he managed to make some profit from the stock’s fluctuations.

“I’ve been a WSB member since 2019,” Li said. “I thought it would be interesting to join in on this historic event where retail investors beat hedge funds for the first time. I also wanted to grab some quick cash since the stock price was so volatile.”

Li’s trade on GME made him $2,000 in one day, and changed his perspective on trading and investing in stocks. He took a small position relative to his total portfolio value, which is valued at over $100,000.

“Yes, Wall Street may prevail in this war, but this frenzy shows that this war between retail investors and institutions has just started,” Li said. “I'm very interested to see what the U.S. Securities and Exchange Commission will do about this.”

For years, Li said that Wall Street and institutions have displayed corruption that have led to drastically decreased well-being for regular people. And everytime, Wall Street has won, with little to no consequences. To Li, this is a turning point in this war.

In the years leading up to 2009, the government, banks, rating agencies, real estate agents and a number of institutions on Wall Street were involved in an economic crisis that wiped $2 trillion from the global economy and shot up unemployment rates to 10%.

Banks packaged together mortgage backed securities, which were filled with subprime mortgages, a mortgage provided to individuals who have little to no credit. These securities would then be refinanced, leveraged and sold to regular people (often through institutions) as supposedly safe, solid investments, when in fact the underlying asset, subprime mortgages, was unstable at best.

When the adjustable rate loans kicked in in the second quarter of 2007, default rates skyrocketed, and the underlying asset crashed, sending the world into a downward spiral.

In response to this economic crisis, 11 years ago the SEC was ordered to impose rules requiring more transparency for short selling but never implemented such policies.

While no action has been taken so far, after $19 billion were wiped out in a matter of months following the short-squeeze, regulators are facing renewed criticism.

Senior Luca Tang, another regular trader and an officer in the school’s Investment Club along with Li, said he isn’t as concerned about the overarching implications of the short squeeze.

In fact, Tang even took a position of $10,000 after he noticed the naked shorts that were occuring within the stock.

In one day, he made $20,000, although his net gain sits at around $12,000.

“It was a positive experience,” Tang said. “I learned to observe the market analytically, but it was more entertaining than educational to be honest.”

Where Li and Tang had taken a position on GME, another student who requested anonymity chose to bet on AMC. Similarly, this play relied solely upon the ability of retail investors to inflate the stock price. And at first it paid off big: by leveraging his portfolio through borrowing $100,000 he was able to go $60,000 green within one day. Thinking the price would continue to climb, he didn’t sell.

The next day, however, various brokerages began to restrict trading, and as volume died down, AMC crashed. Ultimately, the student lost a net total of $35,000.

Prior to entering this trade, his portfolio had been valued at $50,000, what he called two years of “hard earned money.” Although he is now down to $15,000, the trader remains optimistic.

“When viewing this from a learning perspective, it is a positive learning experience,” he said. “It allowed me a ‘final lesson’ to not enter stocks that are hyped, and to be aligned with value-investing principles.”

The biggest losers were retail investors who shorted, and two investment firms who also took short positions: Melvin Capital and Citron Capital, two companies with already-dubious credibility and investing ability on Wall Street.

“This was an important reminder to remain principled within my life in and out of investing, and to not fall for the chaos of the mob,” he said.