As millions were confined to their homes in 2020, stock brokerages saw one of the largest increases of all time in retail investment. Yet with 80 percent of traders losing money and only 10 percent managing to make any amount, the financial markets proved to be an unforgiving battleground even in a bull market.

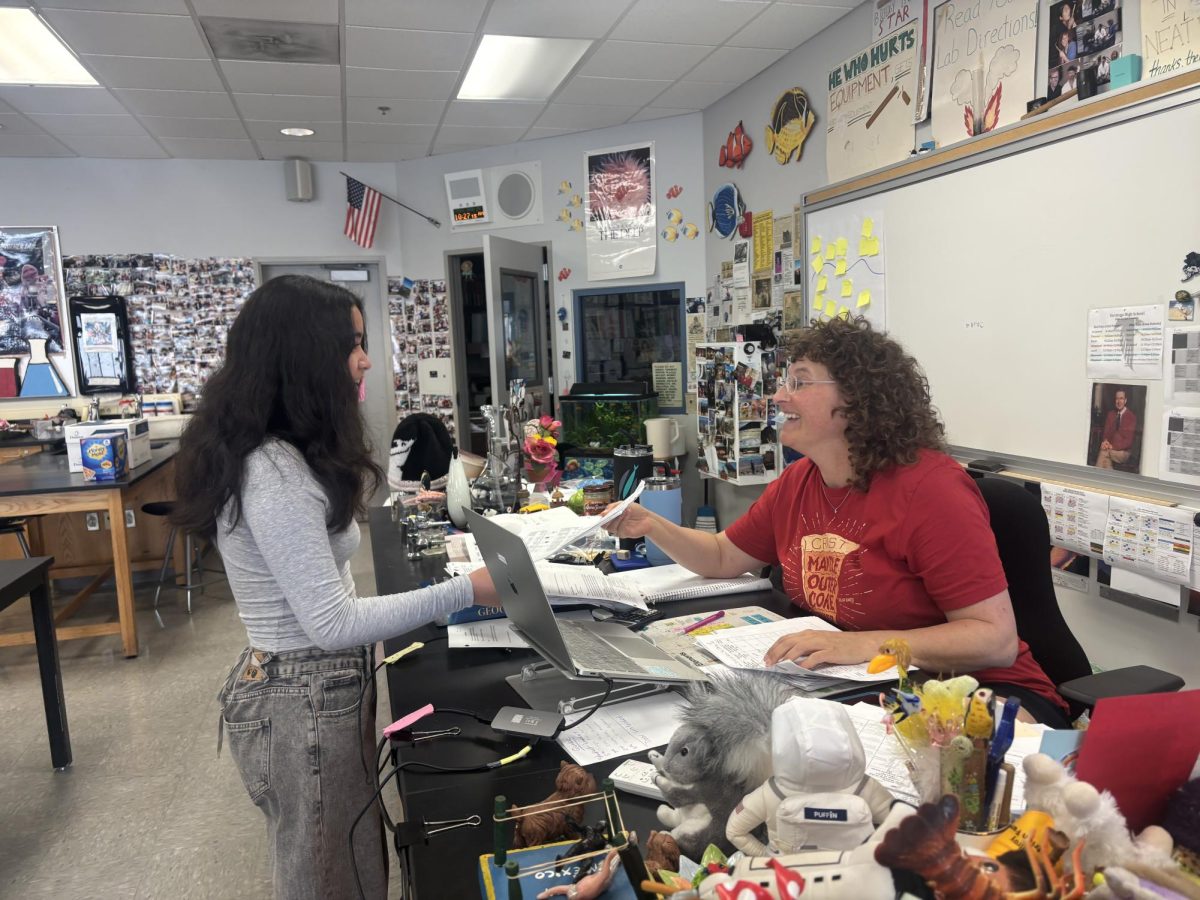

After 12 years of inactivity, the Investment Club was revived in October. Led by co-presidents senior Luca Tang and junior Dhruv Singh, juniors vice-president Jonathan Li, treasurer Arnav Bhola and secretary Peter Li, the club covers topics ranging from taking short-term and long-term positions in the stock market to understanding asset classes.

“Trading the markets is very difficult,” Singh said. “This club serves as a community for students willing to learn about finance and investing.”

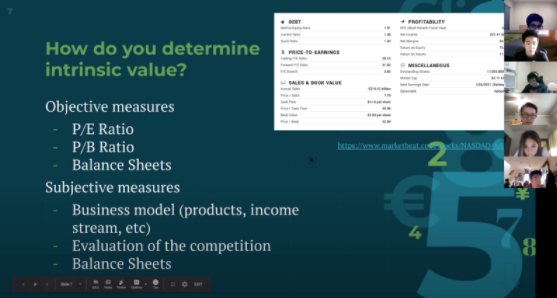

Combined, the club’s members’ individual portfolios are valued at around half a million dollars. Meetings, now held virtually through Zoom, consist of regular news coverage of the stock market, slides detailing concepts of the financial markets and due diligence on a number of stocks worth watching.

For members from other schools or with conflicting schedules, the club also has a Discord server with 60 members, where stock callouts, valuable sources for stock analysis and regular discussions on stocks are posted.

In the near future, the club looks forward to hosting prominent speakers from various backgrounds, such as financial analysts, hedge fund managers and successful retail investors.

“This club is an opportunity for new audiences to be introduced to stocks,” freshman William Cao said. “We’re able to get together and share stock ideas, which is cool.”

The club’s most recent project is a shared club fund that offers scholarship opportunities for members.

According to Singh, through “collective decision making,” the club-fund will be scaled. Upon reaching $10,000, the club will be eligible to distribute scholarships to those who contributed using the money raised from the fund. The club hopes they will be able to do so by next year.

Every other week, during meetings, members will vote on positions to take. Since the club has acquired a 501(c)3 tax-exempt nonprofit status, earnings made from the stock market using the club-fund are not taxed and donations to the club’s fund are tax deductible.

However, according to Singh, since maintaining a nonprofit requires regular filings of certain documents and the club as a legal entity has remained dormant for some time, there will need to be a little bit of legal housekeeping before members start making trades.

When it opens, Bhola believes the club fund will represent a great opportunity for new members to dip their toes into the stock market. Trading and investing with real cash is significantly more difficult than simulated trading with “paper,” or pretend money.

“What makes it great is that, once we have a bit more money, it will allow us to make trades as a club and go over the fundamental and technical analysis that will be involved when considering a company,” Bhola said.

At the moment, the account contains $1,500, which has been raised through grants and fundraising activities. The officers are looking to raise some more cash for members to trade. Within the next month, trading will commence.

“Investment Club's mission is to teach members about the stock market and foster their interest in making money,” Bhola said. “We believe that this club account will allow us to execute this mission to the fullest as members can apply concepts and trades executed through the club account in their own stock ventures as well.”