It’s 5:45 a.m. Light flickers from behind the drawn blinds of junior Dhruv Singh’s room. He’s already hunched over his computer, his eyes jumping from monitor to monitor, examining stock scanners, various news outlets and his stock brokerage, WeBull.

Singh, co-president of the Investment Club, has about three hours before he has to log on to Zoom for his first-period class, but until then, $25,000 is waiting for him to trade.

Singh is a day trader — someone who buys and sells stocks over a brief time frame. It has recently become an exciting, stressful and sometimes lucrative hobby for many teens.

Upon the outbreak of COVID-19, stock brokerages witnessed exponential growth in user counts, according to CNBC. Popular firms such as TDAmeritrade, Charles Schwab and Etrade saw an average growth of over 125 percent in the number of new users in the first quarter of 2020 compared to the number of new users acquired in the first quarter of 2019.

As opposed to investing, trading offers significantly higher potential returns but with additional risk. As such, most renowned investors such as Warren Buffet preach selecting a portfolio of fundamentally sound stocks and holding them for long-term gains.

Singh said he chose to start day trading to satisfy his curiosity and to pursue his passion for finance.

“I had been infatuated with the financial markets for years,” Singh said. “I saw it as the synthesis between chess and poker, which are my favorite games.”

Last October, his parents gave Singh $200 to invest in the stock market. Ordinarily, individuals may have taken long-term positions in popular indices such as the S&P 500 or blue chip companies (established companies such as Microsoft or Apple), but Singh chose to start trading in penny stocks.

“I wanted my account to grow 15 percent per month,” Singh said. “It’s difficult to find large growth in blue chips over a short time-frame, which naturally gravitated me towards volatile penny stocks that I could predict using statistical analysis.”

The S&P 500, over the last 90 years, has averaged a yearly return on investment (ROI) of 9.8 percent. Although it is a considerable return from an investor’s perspective, it was small compared to Singh’s goal.

Penny stocks trade for under $5 per share, offering the potential for thousands of percent in growth in a few hours or even minutes. However, they can fall equally fast, making them extraordinarily risky trades and investments. Because of this, trading such stocks requires traders to have an immense amount of control over their emotions as well as patience.

“I've conditioned myself to avoid emotions entirely over the course of my trading career,” Singh said. “Emotions tend to lead towards irrationality, and irrationality leads to imprudent decision making.”

This emotionality contributes to a psychological phenomenon called random reinforcement, the primary reason 90 percent of stock traders fail to make money in the stock market. Random reinforcement occurs when traders begin to use movements in price to qualify or disqualify a hypothesis; however, due to market unpredictability and irrationality, price movements are often arbitrary, occasionally rewarding bad habits and punishing good habits as such.

According to wealthwithin.com, 80 percent of traders lose money, 10 percent manage to break even, and 10 percent manage to grow their accounts.

Singh has grown his account by 2,500 percent since he started last October.

He surpassed his goal of a 15 percent gain per month with a growth from $200 to $5,000 in less than one year. His success in the markets has opened doors for him to give financial advice for family friends, which has made him an additional $20,000 through commissions. Singh now has his eyes set on becoming more financially independent before college. By the time he graduates, Singh hopes to scale his account to around $50,000-100,000.

After college, he is planning on establishing an investment firm or working at a hedge fund. Singh hopes to manage bond and capital markets in addition to making long-term value investments for himself and clients; he has begun scaling portfolios with an average ROI of 3 to 5 percent a week.

Singh’s success encouraged his peers and fellow investment club members to invest and trade stocks.

Teens who enter the market not only gain glimpses into the financial service industry as a career, but also learn the fundamentals for managing their own funds.

Filing taxes, preparing retirement plans such as 401ks and IRAs, managing and investing funds effectively to outpace inflation and establishing a passive income stream before college are all valuable skills. However, stock trading is far from a magical path to financial success.

Where Singh had initially entered the stock markets to explore his passion in finance, senior Luca Tang, co-president of the Investment Club, said he became a trader in pursuit of quick riches.

For the first three months of his trading career, which started when Tang was a freshman, he lost money, and his initial investment of $10,000 — a loan given to him by his parents — had mostly gone down the drain.

“It was really discouraging,” Tang said. “But with the support of my parents and advice from a financial advisor, I managed to go positive.”

For him, the first step was becoming more conservative in his approach and trading stocks over longer time-frames.

It was the right move. In the next three years, he made $200,000. His portfolio is now valued at more than a quarter million dollars and contains a diverse assortment of companies from various sectors.

With only 10 percent of traders making a profit, and significantly fewer able to grow their accounts more than a few percent, Tang is among the few who have managed to turn their portfolio around. Doing so meant that he not only had to have an extensive understanding of market movement and the intrinsic and potential values of a company, but also their risks.

“If I want to put money in a stock, I already know about the possible risks that I have to take,” Tang said. “I determine the volatility of that particular stock, then I look into the current events about the company to determine if it is worth my money.”

The returns didn’t come easily. Tang spends hours every week scanning the market, analyzing and trading stocks — often at the detriment of his health or academic performance.

“My grades slipped, I wasn’t getting nearly enough sleep to stay attentive during class,” Tang said. “But it was worth it.”

In early October, Tang’s parents decided to lock his trading account because of his slipping grades. Though stung by the decision at first, he said that it has been nice to take a break from the stress of managing stocks.

Following the 40 percent drop in value across major indices in March, new stock traders poured cash into the stock market and were rewarded as it made a historic comeback, shooting past all-time highs. Yet in recent months, the markets began to stagnate, and inexperienced traders and investors who might have been fooled by the market’s sudden uptrend could easily have their accounts wiped as gambles made earlier this year are no longer paying off.

With the time trading and investing in stocks required, it can be a particularly difficult pursuit for new investors and traders since it’s so easy to lose money.

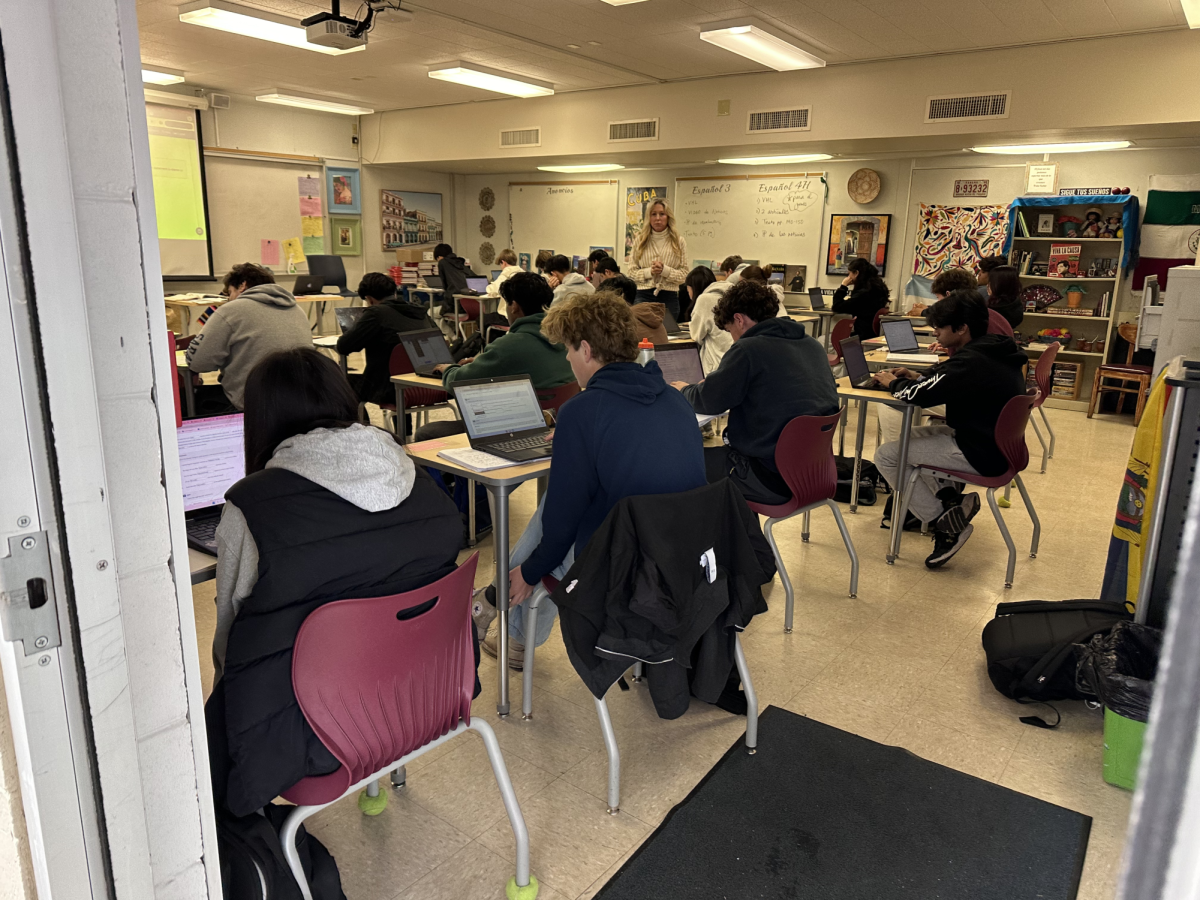

To help others get started with trading, Singh and Tang decided to team up with me and juniors Arnav Bhola and Peter Li to restart the Investment Club in September, which had last operated nine years ago.

“We wanted to teach financial literacy and create a community for those interested in the financial markets,” Singh said.

While the other officers have not achieved returns comparable to Singh’s yet, they have found the community and network of student investors and traders engaging and useful.

For beginners, Singh recommends trading with small sums at first and also using simulators to understand market patterns and risks. His favorite simulator to achieve a higher level of financial literacy is Investopedia. Similarly, Tang suggests trading on simulated brokerages and reading about the basics of operating a broker — such as account-types, regulations and legalities. He also advises beginners to learn the effects of government regulations, company actions or any news about the company on stock prices.

“It’s a crazy world,” Tang said. “The market’s irrational; no one can predict 100 percent of the time where it’s going to be heading the next day.”