Elasticity. Market Price. Scarcity. Seniors read these words over and over, memorizing their definitions for the next Economics test. The current curriculum for the required class explores the basic principles of the subject: supply and demand, advantages and disadvantages of different kinds of businesses, and the price system. But in this class and perhaps in others, seniors should be learning something even more basic — personal finance.

Seniors are immersed into a curriculum where they learn the applications of money in an economic system, but they learn little knowledge to apply to their daily lives. The truth is that high school graduates need to know how to manage their money, save, invest, pay bills, buys houses and cars and insurance, and deal with the large debt they will accumulate in higher education.

Personal finance is not only an explanation of how to save and spend, but also a guide to managing checking accounts, loans, and essentially any interaction between a customer and a financial institution. If seniors receive an education on these topics, they will be more prepared for college and beyond.

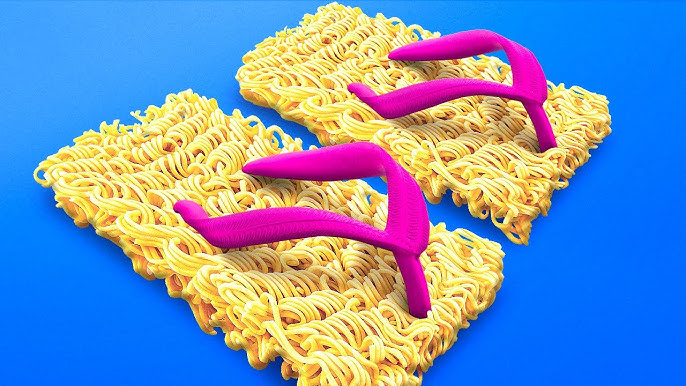

For example, a personal finance unit could teach students how to make useful purchases on food, clothing, books and essentials they will need to buy. When they are left to be independent in college and beyond, they will know better than to spend all their extra money on snacks or new outfits, and will save more of it for necessities such as toiletries and school supplies.

One way teachers can incorporate personal finance into the curriculum is through simulations, which should be straightforward to organize. For example, students can practice using ATM machines by just going on the Internet or rehearse safe monetary transactions in class-wide “mock markets.” Or they could simulate trying to put the money together to buy a house or pay off college depending on the path they choose.

One problem teachers may be currently facing that would hinder the adding of a personal finance unit into the Economics curriculum is lack of time. Since Economics is combined with AP or college prep Government and Politics, teachers are only given one semester to teach Economics before they have to switch over to the next topic.

Still, given its importance and relevance, teachers should not use lack of time as a reason to omit personal finance from the curriculum completely; instead, they should rearrange and cut down on the other, less relevant units to make space for it.

For example, one of the topics currently covered in Economics, the market system, could be reduced and supplemented by a unit on personal finance.

Seniors will likely not be able to apply the concept of finding the market-clearing price or the elasticity of demand in their upcoming lives, but they will be engaging in crucial monetary transactions such as the difference in loan rates on a daily basis. seniors will soon be on their own, free to make their own decisions.

Learning about personal finance would provide a necessary introduction to financial situations students will face as they continue to grow up. After all, personal finance is the backbone of anything and everything in economics, and if we’re headed to college in a year, we should probably know more about how to manage our money.